Bitcoin surged to a two-month high after breaking above the $95,000 resistance level, triggering nearly $700 million in liquidations and shifting short-term market momentum. The breakout forced heavily leveraged traders to exit short positions, accelerating buying pressure and lifting broader crypto market sentiment.

Bitcoin climbed as high as $96,600 on January 14, its strongest price level since November 2025, before entering a brief consolidation phase. The move marked a clear shift in short-term market structure after multiple failed attempts to reclaim the $95,000 level in recent months.

Short Liquidations Fuel Bitcoin Rally

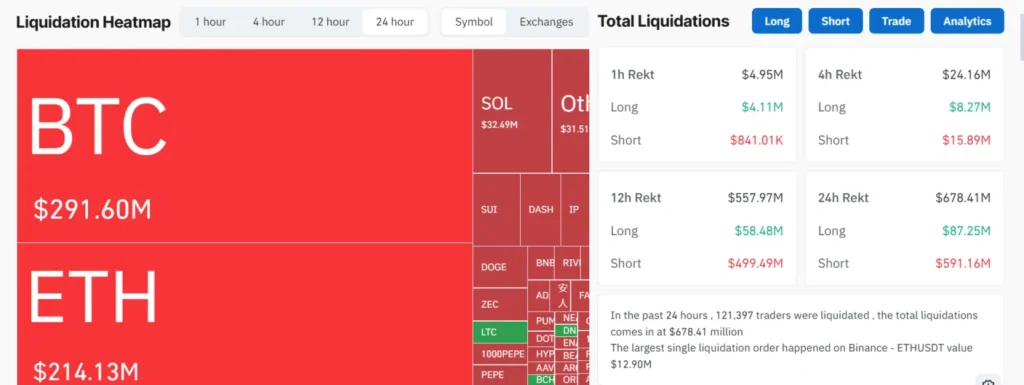

The rally had an immediate and significant impact on derivatives markets. Futures data shows that approximately $678 million in leveraged positions were liquidated over the past 24 hours.

Of that total, around $591 million came from traders positioned on the short side, highlighting how crowded bearish bets had become near resistance. Once Bitcoin pushed above $95,000, forced short covering amplified upward momentum.

At the same time, futures open interest fell from $31.5 billion to $30.6 billion at press per Coinalyze data, signaling a sharp reduction in leverage. Notably, declining open interest during a price rally is often viewed as a sign that spot market demand, rather than speculative leverage, is driving the move.

$95,000 Resistance Break Marks Key Technical Shift

Bitcoin’s move above $95,000 carried notable technical significance. The level had capped upside attempts on December 3, December 10, and January 5, establishing it as a major supply zone.

Those repeated rejections encouraged short sellers to defend the area aggressively. But this time, sustained buying pressure overwhelmed sellers, flipping former resistance into a potential support level. Several top market analysts now view the breakout as an inflexion point for near-term momentum.

Altcoins Rally as Capital Rotates

Bitcoin’s strength quickly spread across the broader crypto market, ending a prolonged period of consolidation among altcoins.

Ethereum has gained 6.6% over the last 24 hours to $3,327, supported by improving sentiment and renewed inflows. Several mid-cap tokens posted double-digit gains, including Optimism (OP), which climbed 13%, while Celestia (TIA) and Pudgy Penguins (PENGU) advanced by roughly 10% each.

DASH emerged as one of the strongest performers, surging to its highest level since 2021 amid elevated trading volume. At press time, DASH is trading at $59.74, up 33% over the past 24 hours.

As altcoins gained traction, Bitcoin dominance slipped to 58%, down from 59.3% recorded on December 24, according to CoinMarketCap. The decline suggests growing risk appetite and capital rotation beyond Bitcoin.

Buttressing this view, Bitcoin and Ether ETFs recorded sizable outflows at the start of 2026, while XRP and Solana attracted high ETF inflows. Moreover, as previously reported by Nitadel, altcoins outperformed Bitcoin in early 2026, with Ether and memecoins posting notable gains.

Market Sentiment Turns Bullish

The breakout follows an extended period of cautious positioning and bearish sentiments across crypto markets. Heading into 2026, BTC lacked clear bullish catalysts after a major $19 billion liquidation event in October 2025 severely damaged sentiment.

In the months that followed, many investors reduced crypto exposure and shifted capital into traditional safe havens such as gold and silver, alongside high-growth AI-focused equities. At that time, the crypto fear and greed index frequently dipped into “extreme fear,” a condition historically associated with market stabilization rather than prolonged declines.

The current Bitcoin price surge above $96,000 suggests that positioning is shifting again, with traders reassessing downside risks as momentum rebuilds.

Key Bitcoin Levels Now in Focus

With BTC trading at $95,038 at the time of writing, attention has turned to whether the market can sustain higher levels.

Traders are closely monitoring $94,500 as near-term support. A successful hold above that zone could open the door to a move toward $99,000, an area that previously acted as support between June and November 2025, and may now serve as resistance.

However, failure to defend $94,500 could see Bitcoin retreat into its prior trading range between $85,000 and $94,500, where price consolidation dominated much of the past quarter. Notably, Bitcoin saw its worst Q4 performance in 2025.

In the meantime, the sharp reduction in leverage, improving sentiment, and rising momentum across altcoins suggest the crypto market may be entering a new phase, with short-term price action likely to determine whether the breakout develops into a prolonged uptrend.

Meanwhile, reducing leveraged positions and growing momentum across altcoins suggest that the crypto market may be entering a new phase. In the short term, price action will likely determine whether this breakout develops into a sustained uptrend.