Bitcoin slipped below the $100,000 mark twice this week, hitting four-month lows as intense selling pressure swept across the crypto market. The decline pushed BTC price to $99,376 on Friday before recovering above $100,000.

This recent price action has raised fresh doubts about how stable the crypto market really is after the October 10 crash that erased about $20 billion in value.

Accordingly, several analysts have warned that the Bitcoin price could go lower in the short-term if selling pressure increases.

$98,000–$100,000 stands as Bitcoin’s critical support level

Crypto traders remain divided on what triggered the sudden wave of selling, but many agree that the market still looks fragile.

Pseudonymous crypto analyst, HORSE, sees the possibility of BTC dropping to the $91,000 region if the ongoing selling pressure causes bitcoin to lose $98,000–$100,000 support zone.

Likewise, he hinted that BTC could bottom out in the short-term if the $100,000 zone does not become another trap. According to him, large round numbers often attract high liquidity, and when they break, the market can move sharply.

He said, “Maybe you get a trap at this low, but if not, these are the levels I am looking toward for Bitcoin. You want to see $100K get front ran, because big round numbers like that, if traded, get smoked on the return just like on the way up.”

With BTC trading above $100,000 at the time of writing, traders are watching closely for signs of strength or another leg down.

Liquidity gaps increase risk of deeper declines

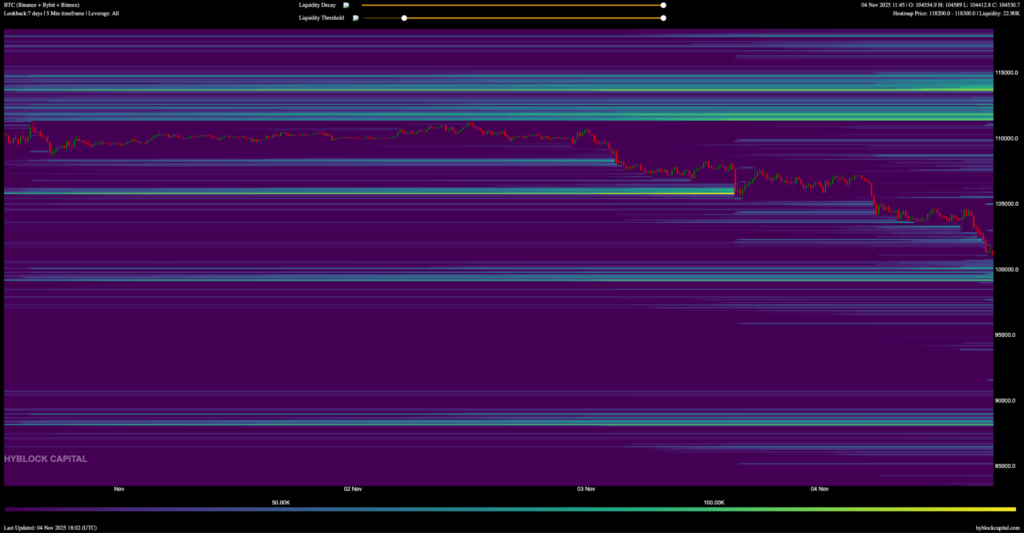

Data from blockchain analytics platform Hyblock has revealed a tight cluster of leveraged long positions built around $100,000 BTC price level. As BTC dipped below that level on Tuesday and Friday, those positions became vulnerable to liquidation, adding fuel to the ongoing sell-off.

As shown on Hyblock heatmap, liquidity thins out quickly below $100,000 until the $88,000 zone. This liquidity gap means bitcoin could face deeper price declines to $88,000 if sellers continue to dominate the market.

Technical Indicators signal bearish momentum

Some analysts are also focused on Bitcoin’s relationship with key technical levels. According to crypto analyst Scott Melker, bitcoin “has definitively lost the weekly 50-MA as support 4 times in history,” [and each time], “price went on to test the 200-MA.”He added that BTC “price is currently $700 above the 50MA. The 200 MA is sitting around $55,000 (and rising).”

While there’s no certainty that BTC would revisit the $55,000 level, the historical pattern is enough to keep traders from being overexposed.

Institutional pressure may still be unfolding

The October 10 crash led to over $20 billion in crypto liquidations, and some experts suggest that certain institutional trading firms may still be dealing with the aftermath.

In a recent X post, options trader Tony Stewart submitted that some Funds hit hard during the crash may be offloading BTC quietly to manage their losses.

He opined that although these affected firms remain unknown, their actions may be adding to the heavy selling seen this week.“

If there is a large dead body yet to rise to the surface from 10/10, there will by now be large firms that can see the blurred body image underwater,” Stewart said. “Whether Crypto or Tradfi, there are ways of identifying if large firms are struggling/hiding/mitigating/exiting,” he added.

Amid this market uncertainty, BTC has recovered to $102,544 at the time of writing, and is up by over 2.5% in the past 24 hours.