Ethereum, the largest smart contracts-enabled blockchain, is preparing for one of the most notable upgrades in its history since the Merge, Dencun and Pectra hardforks.

In 2026, the network is expected to roll out two major hardforks, including Glamsterdam and Heze-Bogota. Both are designed to make Ethereum faster, more efficient, and significantly harder to censor.

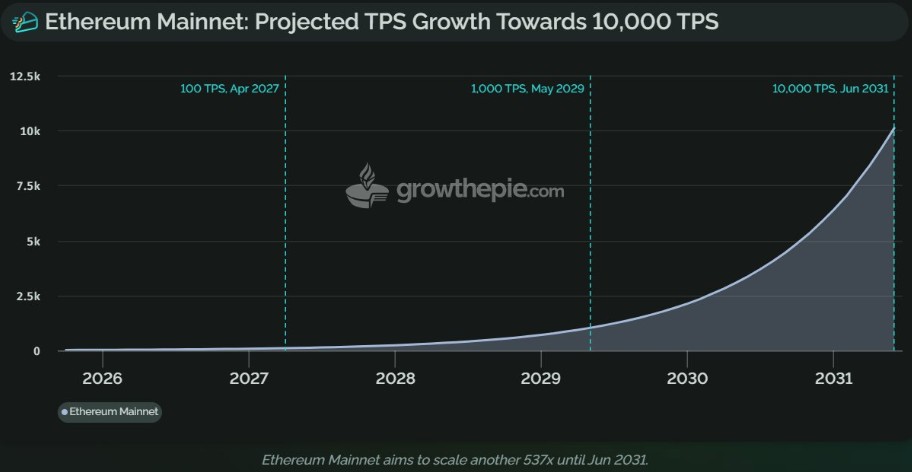

Together, these upgrades lay the technical foundation for Ethereum Layer 1 (L1) to eventually process up to 10,000 transactions per second (TPS), while enabling Layer 2 (L2) networks to scale into the hundreds of thousands of TPS.

While those headline numbers may not be reached immediately, 2026 marks a decisive shift in how Ethereum scales and protects its core values.

Why Ethereum Needs These Upgrades

Notably, Ethereum processes transactions largely in sequence, which limits throughput and creates congestion during high demand. At the same time, concerns around validator centralization, maximal extractable value (MEV), and transaction censorship have grown as the network has matured.

The 2026 roadmap addresses these challenges directly. The focus is on three major improvements: parallel execution, higher gas limits, and zero-knowledge (ZK) proofs at the validator level. Combined, these changes would allow Ethereum to do more work per block, reduce bottlenecks, and strengthen neutrality without compromising decentralization.

The Glamsterdam Upgrade: Block Access Lists (EIP-7928) and Enshrined Proposer-Builder Separation (ePBS)

Scheduled for mid-2026, the Glamsterdam hardfork is primarily about performance and scalability. One of Glamsterdam’s most important upgrades is Block Access Lists (EIP-7928). Despite the name, this is not a censorship mechanism. Instead, it enables what many developers describe as “perfect” parallel processing.

Recall that Ethereum processes transactions one after another, like cars stuck in a single-lane road. Block access lists turn that road into a multi-lane highway.

Specifically, block producers include a detailed map showing which parts of Ethereum’s state each transaction touches. With this information, Ethereum clients can safely execute multiple transactions at the same time across different CPU cores.

This change removes one of Ethereum’s biggest bottlenecks, which is repeated disk reads during execution. By preloading required data into memory, clients run blocks faster and more efficiently, unlocking higher throughput without needing extreme gas limit increases.

Glamsterdam also introduces Enshrined Proposer-Builder Separation (ePBS), moving a system already used by most validators directly into Ethereum’s core protocol.

At the time of writing, over 90% of blocks on Ethereum rely on MEV-Boost, an external system that separates block building from proposing but depends on centralized relays. ePBS brings this process on-chain, making it trustless and reducing centralization risks.

From a scalability perspective, ePBS is critical because it allows delayed execution. Validators will no longer be penalized for taking extra time to verify blocks, which makes it practical to validate zero-knowledge proofs.

Ethereum researchers like Justin Drake estimate that by the end of 2026, around 10% of validators could switch from re-executing transactions to simply verifying ZK proofs. This development dramatically reduces computation overhead and opens the door to further gas limit increases.

Higher Gas Limits on Layer 1 Networks

Ethereum’s gas limit has already increased to 60 million. In 2026, that number is expected to rise sharply. Estimates suggest an increase to 100 million gas in early 2026, followed by up to 200 million gas per block after ePBS goes live. Some projections even suggest 300 million may be possible before the end of the year.

While Ethereum co-founder Vitalik Buterin has noted that future increases may be more targeted, the overall direction is that Ethereum L1 is becoming far more capable.

Per a November X post, he “expects continued growth but more targeted / less uniform growth for next year. eg. One possible future is: 5x gas limit increase together with 5x gas cost increase for operations that are relatively inefficient to process.”

Read also: Ethereum Regains Momentum Against Bitcoin as Top Analyst Identifies Key Zone To Buy ETH

What This Means for Layer 2 Networks

Ethereum’s 2026 upgrades won’t just benefit L1 networks as they will significantly enhance the scalability of L2 networks.

The number of data blobs per block—used by rollups to publish compressed transaction data—could rise to 72 or more. This provides L2s with vastly more bandwidth, enabling hundreds of thousands of transactions per second across rollup ecosystems.

Usability is expected to improve as well. For example, ZKsync’s Elastic Network allows users to keep funds on the Ethereum mainnet while trading in fast L2 execution environments. A new Ethereum Interoperability Layer is also being designed to make movement between L2s seamless, reducing fragmentation.

The Heze-Bogota Fork: Strengthening Censorship Resistance

Scheduled for late 2026, the Heze-Bogota fork focuses less on speed and more on Ethereum’s core principle of permissionless access.

Its key feature is Fork-Choice Inclusion Lists (FOCIL). This mechanism allows groups of validators to require that specific transactions be included in blocks. As long as part of the network remains honest, transactions cannot be permanently censored.

This ensures Ethereum remains a neutral infrastructure, even under regulatory or political pressure. While FOCIL does not directly increase throughput, it reinforces the network’s long-term resilience.

Read also: VanEck analyzes investment case for Ethereum, sets ETH 2030 price targets

A Foundation for Ethereum’s Next Decade

Glamsterdam and Heze-Bogota will not instantly turn Ethereum into a 10,000 TPS chain. What they do is far more important, which is changing the platform’s scaling trajectory.

With parallel execution, ZK-based validation, higher gas limits, and stronger censorship resistance, Ethereum is laying the groundwork for sustainable, decentralized growth. L2 networks will become faster and easier to use, while L1 becomes more efficient and robust.

By the end of 2026, Ethereum is expected to be faster, more decentralized, more scalable, and more aligned with the principles that made it valuable in the first place. Citing these planned upgrades and rising capital shifts from Bitcoin to Ether exchange-traded funds (ETFs), Standard Chartered sees ether (ETH) outperforming BTC in 2026, revealing key price targets.

Maintaining upward momentum above key simple moving average levels, ETH has gained significantly in January, outperforming bitcoin. However, amid recording sizable outflows from spot Ether ETFs in early 2026, ETH has surged to $3,345 at the time of writing.