While many altcoins, including SEI, continue to struggle in the current market downturn, analysts believe the extended decline may offer attractive accumulation opportunities.

In a recent X post, popular crypto founder and market analyst Michaël van de Poppe shared a bullish outlook on the altcoin sector, projecting a significant upside move for SEI.

SEI Positions for a Potential 293% Surge

SEI, the native token of the Sei Layer-1 blockchain, has remained in a downward trend since topping above $0.649 in late 2024. Even with the Donald Trump-backed crypto initiative, World Liberty Financial’s purchase of 547,990 SEI tokens worth $125,000 in February, the asset has failed to build sustained bullish momentum.

At the time of writing, SEI is down more than 60% year-to-date. The token has also fallen 51% over the past 90 days, 19% in the last 30 days, and 5.5% in the past week.

Despite this weakness, van de Poppe believes SEI is developing strength around a critical support zone. On the weekly chart, he highlights $0.1573 as a firm support level that has been retested multiple times from April to November 2025.

If this level holds, the analyst expects SEI to revisit the December 2024 high near $0.649. From its current price of $0.165 at the time of writing, SEI would need to rally more than 293% to reach that target.

Is This a Good Time to Accumulate Altcoins?

Commenting on broader market conditions, van de Poppe described altcoins as being in “an extremely bad status.” However, he pointed out that historically, periods of sharp declines have presented strong accumulation opportunities for both Bitcoin and altcoins.

His comments were made during the latest market sell-off, which pushed Bitcoin below $92,000 and triggered widespread liquidations. Many altcoins have since dropped to new lows, with some revisiting all-time low price regions.

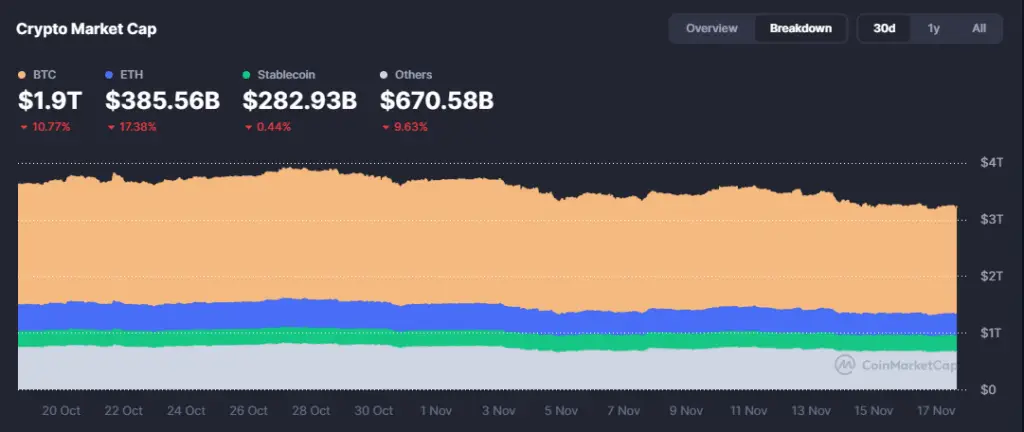

The pullback has driven the total global crypto market cap down to $3.24 trillion as of November 17. Notably, altcoins (excluding stablecoins) represent just $1.056 trillion of this value, while Bitcoin alone accounts for $1.9 trillion. Meanwhile, the CoinMarketCap Altcoin Season Index sits at 31/100, reflecting weak altcoin performance relative to Bitcoin.

As previously reported by Nitadel, van de Poppe maintains that the altcoin cycle isn’t over, insisting the market hasn’t seen any real bull run yet.