Despite high market volatility, September 2025 was a defining month for Kamino, as the Solana-based decentralized finance (DeFi) protocol achieved new performance highs.

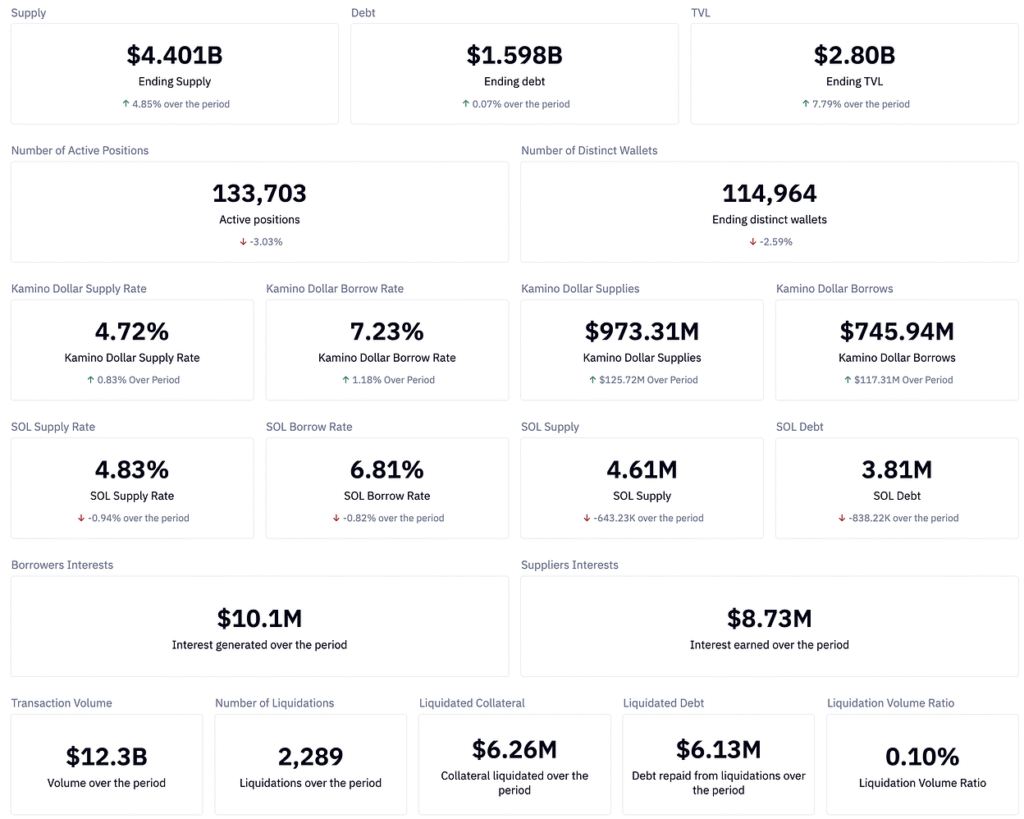

According to a report, the platform demonstrated remarkable stability and user confidence, recording a total supply of $4.4 billion (+4.9% month-over-month) and a total value locked (TVL) of $2.8 billion (+7.8%).

Even with market uncertainty, Kamino’s borrow demand remained steady at $1.6 billion (+0.5%) per the report. This indicated that users are maintaining trust in its lending ecosystem while taking a more balanced approach to risk.

This period also marked significant progress across Kamino’s vault and stablecoin products, which attracted record inflows as investors sought safer, yield-generating opportunities.

From vault expansion and real-world asset (RWA) integrations to flawless risk management during market stress, Kamino showcased what sustainable growth in DeFi truly looks like.

Vaults and Stablecoins Lead Kamino Finance Expansion

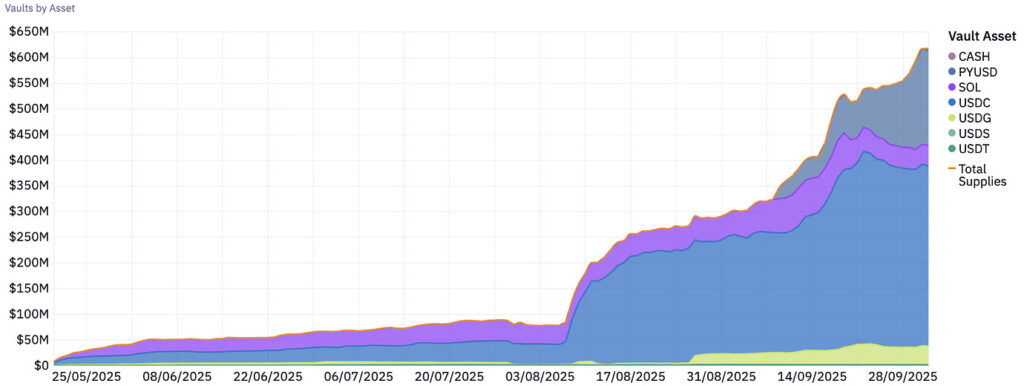

Kamino’s vault layer saw exponential growth, more than doubling in size to $593 million, driven by the success of the USD Coin (USDC) Prime and PYUSD Sentora vaults.

These vaults attracted massive liquidity as users shifted from volatile leveraged strategies toward more predictable, stable yields.

Stablecoin markets played a central role in this expansion. Liquidity in stable assets such as USDC, PUSD, and PYUSD reached record levels, with PUSD alone adding $169 million in new supply, while cbBTC saw a $139 million inflow. This confirmed a growing appetite for Bitcoin-based collateral.

Conversely, SOL markets contracted for the second consecutive month, with supply and debt both falling. This shift highlights a structural rotation away from leveraged staking strategies (LSTs) and into stablecoin and vault-based yield opportunities.

Orderly Liquidations Amid Market Stress

Last month’s final weeks were marked by volatility, with Solana (SOL) falling nearly 25% and several memecoins losing more than 40%. Regardless, Kamino’s risk infrastructure remained remarkably robust.

Over 2,000 liquidations were executed seamlessly, including $6.3 million in collateral seized and $5.9 million in debt repaid. According to the report, this represented less than 0.25% of total activity.

This orderly process reaffirmed Kamino’s liquidation engine efficiency, ensuring no bad debt accumulation and minimal disruption to users.

On average, affected accounts lost just 0.07% of their position size in fees, an impressive indicator of protocol health during market stress.

Kamino Ecosystem Milestones and Innovation

Kamino Finance also recorded key ecosystem achievements in September 2025, including:

- PYUSD Growth Initiative: Incentivized earning opportunities boosted PYUSD liquidity across vaults and lending markets on the platform.

- New Real-World Asset (RWA) Markets: Kamino launched OnRe (reinsurance) and Huma (payment-linked financing), introducing diversified real-world yield on-chain.

- Security Milestone: Kamino Lend contracts underwent formal on-chain verification, reinforcing transparency and trust.

- 3rd Anniversary on Mainnet: The protocol celebrated three years of continuous uptime with zero incidents in September 2025.

These developments positioned Kamino as a leader in DeFi innovation, bridging on-chain finance with real-world opportunities while maintaining top-tier security standards.

Kamino User Behaviour and Transaction Volumes

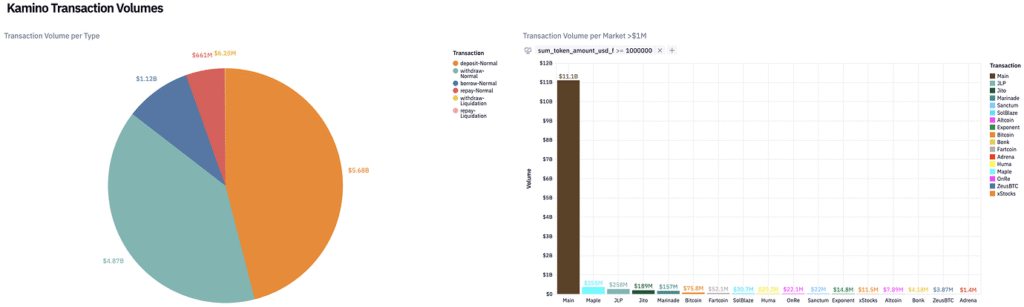

As stated in the monthly report, Kamino processed $12.3 billion in total transaction volume (+3.4% MoM) during September 2025 according to the report.

Deposit activity surged to $5.68 billion (+20%), while borrow volumes rebounded by 44.5%, led by strong demand for USDC and PYUSD.

However, SOL-based borrowing declined, reinforcing the market rotation narrative toward stablecoins and BTC. Withdrawals normalized after the August 2025 high churn, and liquidations rose sharply due to market volatility, though they were managed efficiently.

Kamino also recorded over 114,000 distinct wallets, with vault participation growing rapidly. The platform now serves more than 14,500 cumulative vault suppliers, up 121% month-over-month, confirming broader retail and institutional engagement.

Kamino Finance Enters Q4 with Momentum

Kamino enters the final quarter of 2025 with solid momentum. The platform’s pivot toward stable yield products, vault growth, and RWA expansion positions it for sustained scaling in the evolving Solana DeFi ecosystem.

While SOL remains foundational, stablecoins and BTC have become Kamino’s new growth engines. With transparent on-chain operations, verified security standards, and deep liquidity reserves, Kamino continues to stand out as one of Solana’s most trusted DeFi protocols.

As it advances into Q4, Kamino promises to expand vault participation, onboard new markets, and strengthen risk-adjusted yield while maintaining operational excellence.