According to a recent report from Bitwise, public companies ramped up their bitcoin holdings by a whopping 16.1% in the first quarter of 2025. In other words, top firms are getting deeper into crypto, and it is a sign that bitcoin’s mainstream appeal is stronger than ever.

Rising institutional crypto adoption

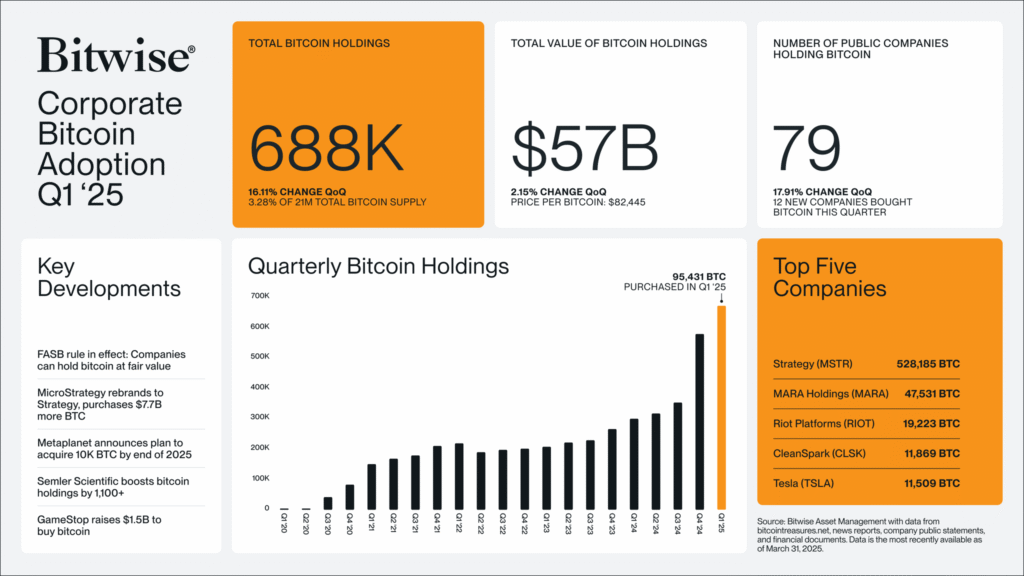

In Q1 2025, publicly traded companies added 95,431 BTC to their treasuries, bringing their total stash to around 688,000 BTC. Representing 3.28% of the total bitcoin supply, these crypto assets are worth over $57 billion.

What’s even more exciting is that 12 new companies, including some fresh faces from Hong Kong, jumped on the bitcoin bandwagon for the first time in Q1 2025.

Lead Benefit, a subsidiary of Hong Kong construction firm Ming Shing recorded the largest first-time bitcoin purchase in Q1 2025. Particularly, the firm bought a total of 833 BTC over the quarter; 500 BTC in January and 333 BTC in February.

Other notable first-time BTC buyers were Rumble and HK Asia Holdings Limited. While Rumble accumulated 188 BTC in March, HK Asia Holdings Limited bought just 1 BTC in February.

Notably, Tokyo-based firm Metaplanet, scooped up 319 BTC in Q1 2025, pushing their total holdings to 4,525 BTC as of March 31.

These growing corporate BTC adoption shows that companies are betting big on BTC as a hedge against inflation and economic uncertainty. With global tariffs and market shifts in play, it is no surprise they are turning to “digital gold.”

Who are the top 5 institutional bitcoin holders?

Per the update, the number of public companies holding BTC jumped to 79 in the first quarter, proving that the leading cryptocurrency by market cap is no longer just a speculative asset but a serious part of corporate strategy.

Of the 79 public companies, Michael Saylor’s Strategy (formerly MicroStrategy), has emerged as the largest-known institutional holder of BTC. As of March 30, 2025, Strategy held 528,185 BTC acquired for an estimated $35.63 billion at approximately $67,458 per bitcoin.

However, following the Monday crypto market dump fueled by the ongoing tariffs war, Strategy accumulated 3,459 BTC at $82,618 per asset on Monday. Accordingly, Strategy now holds a whopping 531,644 $BTC at the time of writing, Saylor Tracker data shows.

With 47,531 BTC in its holdings as of March 2025, MARA Holdings is the second-largest institutional bitcoin holder. Riot Platform follows with a 19,223 BTC stack. The next on the list is CleanSpark with 11,869 BTC in its holdings.

Meanwhile, Elon Musk’s Tesla sits as the fifth-largest corporate BTC holder, boasting over 11,509 BTC on its balance sheet.

Why are companies stocking up BTC?

So, what’s driving this bitcoin boom on institutional balance sheet? For starters, bitcoin’s price has been holding steady around $85,000, up over 2.5% since March 31, 2025. Despite a dip to $75,000 in early April, its strong momentum is catching corporate eyes.

Additionally, with the U.S. exploring a bitcoin reserve and regulatory clarity on the horizon, global companies feel safer allocating funds to crypto. Meanwhile, this trend also screams fear of missing out (FOMO).

As more firms like Block, Inc. (holding 8,485 BTC) Strategy, MARA Holdings, CleanSpark, Riot Platform, Tesla and now Metaplanet make headlines, others do not want to be left behind. It’s a domino effect, and bitcoin’s scarcity (only 21 million will ever exist) only fuels the increasing institutional adoption.

Altogether, the 16% surge in BTC holdings by public companies in Q1 2025 could serve as a positive signal to investors that the bull market is still in play. Institutional crypto adoption is accelerating in 2025 as forecasted in a Coinbase-led survey, and it could stabilize bitcoin’s price while attracting more investors.