SOL is reclaiming the spotlight after the launch of two U.S.-listed Solana ETFs, with its price expected to regain bullish momentum.

The debut of the Bitwise Solana Staking ETF (BSOL) and the Grayscale Solana ETF marked a historic milestone for the Solana ecosystem, especially as institutional access to SOL expands.

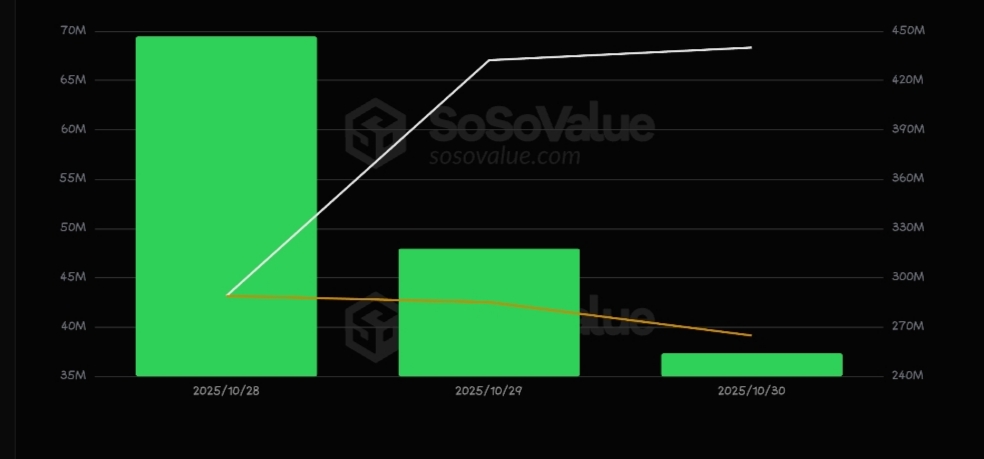

BSOL, which launched on October 28, immediately captured investor interest. Within its opening moments on the market, the ETF recorded approximately $10 million in trading volume, signaling strong demand.

It has now accumulated more than $152 million in net inflows per SoSoValue data, securing a dominant share of ETF-based interest in the asset.

In contrast, the Grayscale Solana Trust (GSOL) launched on October 29, has seen modest inflow totalling around $2.18 million to date.

Combined, both ETFs have attracted $154.78 million in cumulative net inflows at the time of writing, with total net assets sitting around $439.97 million. This implies growing confidence in Solana’s ecosystem and its long-term institutional adoption.

This development positions Solana as one of the few crypto networks with both spot ETF exposure and a significant staking-based investment structure, which many analysts see as a bullish signal for network and utility-driven growth.

Read also: Brazil outruns U.S. in Solana ETF Approval as Institutional Demand for SOL Rises

Solana ETF Hype and SOL Price Outlook

Despite heightened ETF enthusiasm, SOL price action remains choppy. The token climbed to a 24-hour high of $203.44 after the ETF debut but quickly retreated below the psychological $200 barrier, trading around $186.61 at press time.

At the time of writing, SOL is hovering near the 30-period moving average at approximately $186.5. Meanwhile, the Relative Strength Index (RSI) sits around 45, signaling neutral momentum as traders wait for clearer direction post-ETF news.

A decisive breakout above the $198–$200 resistance range, supported by rising volume, may pave the way for a renewed bullish leg. Should momentum strengthen, upside targets sit between $210–$225.

However, failure to sustain demand could push the price back toward the critical $154–$156 support region, an area where buyer activity has historically strengthened.

In the short term, bulls must defend the $165–$168 support zone and secure a breakout above $200 to confirm renewed upside strength.

Rising Institutional Demand in SOL

The SOL ETFs launch in the U.S. market comes amid Western Union’s decision to launch its USDPT stablecoin and digital asset network on Solana. In essence, institutional channels are now opening at scale for Solana, adding long-term capital inflows.

At the time of writing, U.S. spot Solana ETFs represent approximately 0.4% of SOL’s total market capitalization, valued at $439.97 million, compared to the network’s $102 billion market cap. This leaves substantial room for ETF-driven expansion.

More firms, including VanEck, Canary, and 21Shares, are reportedly exploring similar Solana products, highlighting continued institutional interest.

Each ETF approval and inflow increases the probability that SOL’s price will benefit from sustained, structured demand over time, not just speculative trading.