On January 15, Head of Product at X, Nikita Bier, announced a major shift in the platform’s developer API rules that reverberated across the crypto world.

In a public statement, the executive confirmed that X would no longer permit applications that reward users for posting on the platform. According to him, these incentives have caused a surge of low-quality content and automated spam. Since then, several so-called InfoFi crypto tokens have flipped bearish and slumped sharply even though the broader crypto market remains bullish.

What is InfoFi and How Does it Work?

InfoFi is short for Information Finance, a term used to describe social applications that pay users for creating content, engaging with posts or amplifying messages on social media.

Unlike traditional influencer payment arrangements, InfoFi platforms turn posting and reacting into a direct earning mechanism, usually through crypto tokens.

Similar to the ‘dead’ friend.tech project, the idea behind the niche is that if users contribute value to a network by posting or engaging, they should be rewarded. This model quickly caught on in crypto circles, especially on X, where attention is deeply tied to market sentiment and trends.

In practice, however, the promise of earning tokens for posting sparked unintended consequences. Over time, the reward systems encouraged users and bots to flood timelines with repetitive replies, promotional posts and automated content.

X’s product lead described the situation as a flood of “AI slop and reply spam,” making the experience worse for everyday users. In response, X revoked API access for these reward-driven apps to improve the quality of content and combat widespread automated posts.

“We are revising our developer API policies: We will no longer allow apps that reward users for posting on X (aka “infofi”),” Bier wrote on Thursday. “This has led to a tremendous amount of AI slop [and] reply spam on the platform,” he stressed.

InFoFi Tokens Tumble

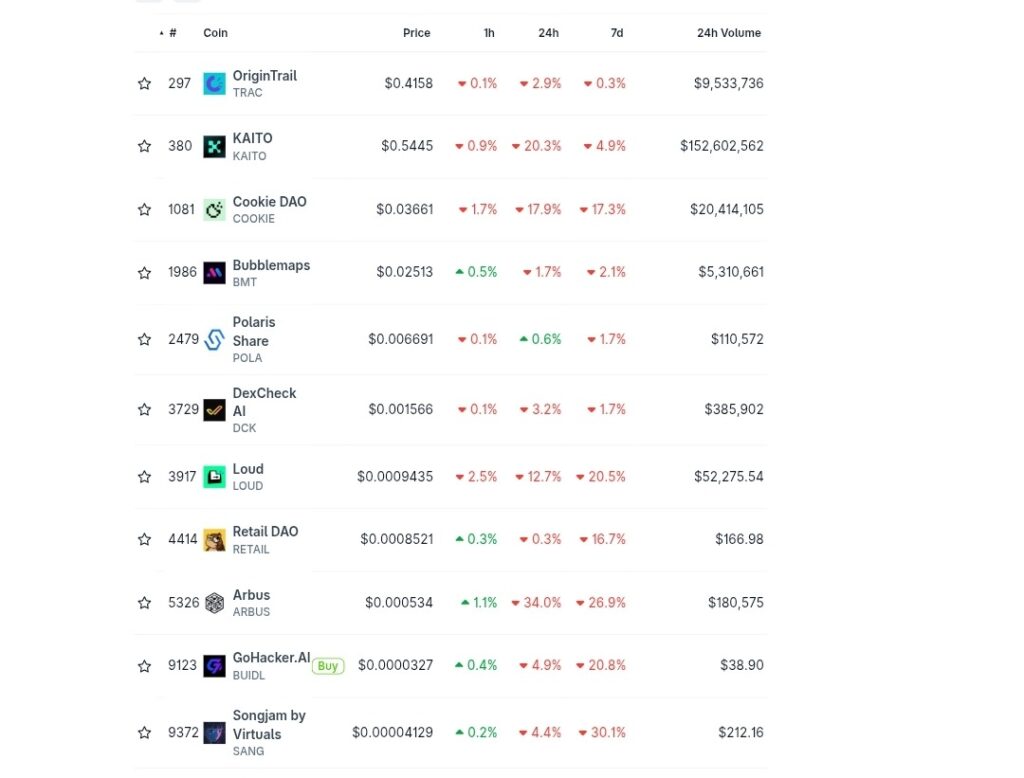

The impact on InfoFi tokens was immediate and notable. Arbus, trading under the ticker ARBUS, dropped 34% in the past 24 hours and is changing hands near $0.000534 at the time of writing.

Kaito’s native token, KAITO, has lost over 20% of its price value in the past 24 hours and is trading around $0.5445 at the time of writing. The Cookie DAO token, COOKIE, has declined by more than 17% within the same timeframe to lows around $0.03661.

Likewise, low-cap InfoFi projects like LOUD (12.7%), Songjam by Virtuals (4.4%), OriginTrail (2.9%), BubbleMaps (1.7%), etc., also saw declines, albeit more modest. Accordingly, the total market capitalization of InfoFi assets has dropped by more than 11% in the past 24 hours after the news broke, settling near $354 million.

Read also: Bitcoin and Crypto Market Hold Steady as ETF Inflows Rebound Amid Venezuela Developments

Kaito, Cookie DAO Change Courses

Kaito, one of the largest InfoFi projects with a market cap of $153 million, confirmed it would sunset its primary reward product, known as “Yaps,” in direct response to X’s policy change.

The company stated it would pivot toward a more selective marketing platform that rewards content creators in partnership with brands rather than relying on broad posting incentives. Particularly, the company has begun a new era of Kaito dubbed Kaito Studio.

Cookie DAO also confirmed it was winding down its “Snaps” incentive campaigns after discussions with X about compliance with the new rules. “InfoFi is changing, and it’s time to sunset Snaps,” the Cookie DAO team wrote.

The teams behind other affected platforms like Xeet have also paused campaigns or reassessed their strategy while evaluating how to move forward without relying on X’s API access.

“While Xeet has never considered itself a true InfoFi platform, we are obviously affected by this decision. We have been assessing our next steps forward,” Xeet stated.

Read also: Bitcoin Hits Two-Month High, Triggers Nearly $700M in Liquidations

A Necessary Reset or the End of InfoFi?

Notable, critics of the InfoFi model argued for months that paying users simply for posting contributions encouraged low-quality engagement rather than meaningful discourse.

Thus, several crypto community members and projects have expressed support for X’s new policy, stressing the need for real value and community engagement in the ecosystem.

Moreover, some analysts now see the recent InFoFi token declines as part of a necessary correction in a niche that never found a sustainable balance between reward and quality.

As the crypto industry digests this development, some projects and developers are looking beyond centralized social networks, exploring decentralized alternatives. How successful these efforts will be remains to be seen, but for now, the InfoFi era on X has been brought to an abrupt end.