Goldman Sachs’ latest regulatory filing offers a revealing snapshot of how major Wall Street institutions are positioning themselves in digital assets and XRP is now part of that picture.

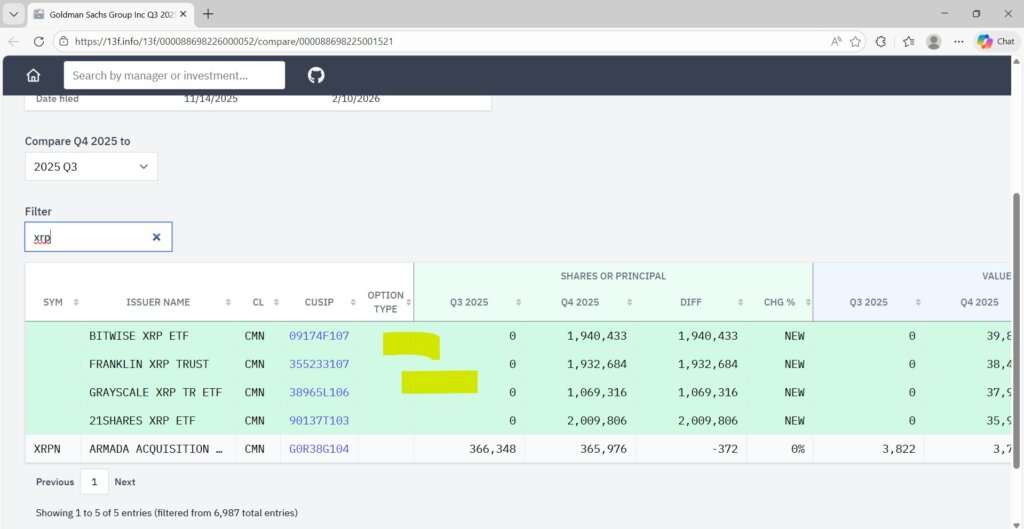

In its Q4 2025 Form 13F disclosure, the investment bank reported approximately $153 million in exposure to XRP exchange-traded funds (ETFs), placing the asset alongside Bitcoin, Ethereum, and Solana within its publicly reported crypto holdings. Host of Crypto In America, Eleanor Terret first shared the update on X.

While BTC and ETH continue to dominate Goldman’s allocation with about $1.1 billion in Bitcoin exposure and $1 billion in Ether products, the inclusion of XRP at a nine-figure level highlights a notable expansion beyond the two largest cryptocurrencies.

The filing also showed roughly $108 million tied to Solana exchange-traded products, suggesting that the bank is building diversified exposure across major blockchain networks.

XRP ETF Market Activity Remains Measured

Despite the significance of Goldman’s position, broader ETF activity tied to XRP remains relatively modest compared to its larger-cap peers. On the day the filing surfaced, XRP ETFs collectively recorded $3.26 million in net inflows, with capital concentrated in products managed by Bitwise and Grayscale.

Other issuers reported no new allocations during the session. Total daily trading volume across XRP ETFs reached just under $15 million, reflecting steady but still developing liquidity conditions.

This dynamic suggests that while institutional capital is entering through regulated vehicles, XRP ETFs have not yet reached the scale seen in Bitcoin and Ethereum exchange-traded products.

Institutional Exposure Extends Beyond ETFs

Goldman’s filing arrives amid broader signals of institutional engagement with XRP. Separate industry disclosures indicate that eight publicly traded companies have earmarked approximately $2 billion toward XRP-focused treasury strategies, pointing to growing corporate-level adoption.

For institutions, ETFs provide a compliance-friendly pathway to gain exposure without direct token custody. The structure simplifies reporting obligations and integrates more seamlessly into traditional portfolio frameworks.

Goldman’s allocation reinforces the idea that large financial firms increasingly prefer regulated wrappers when accessing digital assets.

The timing of the disclosure is notable. Goldman Sachs continues to maintain visibility in digital asset policy conversations in Washington, including participation in discussions related to stablecoin yield frameworks.

These conversations have become increasingly relevant as lawmakers debate broader crypto market structure reforms. Industry leaders from firms such as Ripple and Coinbase have also engaged in recent policy debates, contributing to ongoing deliberations around digital asset classification and regulatory clarity.

Meanwhile, Goldman Sachs CEO David Solomon is scheduled to appear at the World Liberty Financial Forum in Palm Beach, where digital asset regulation and institutional adoption are expected to feature prominently.

While XRP represents a smaller share of Goldman’s crypto portfolio compared to Bitcoin and Ethereum, a $153 million allocation positions the token within the institutional capital conversation. The filing does not suggest an aggressive bet, but rather a calculated inclusion within a diversified digital asset strategy.

For XRP markets, the significance lies less in daily ETF inflows and more in validation through regulated exposure. As institutional investors continue favoring exchange-traded structures over direct custody, XRP’s presence in large bank portfolios could signal a gradual normalization of altcoin exposure within traditional finance.

Whether this allocation expands in future filings may ultimately depend on ETF liquidity growth, regulatory clarity, and sustained institutional demand. In the meantime, Goldman’s position marks a measurable step in XRP’s integration into mainstream financial portfolios.