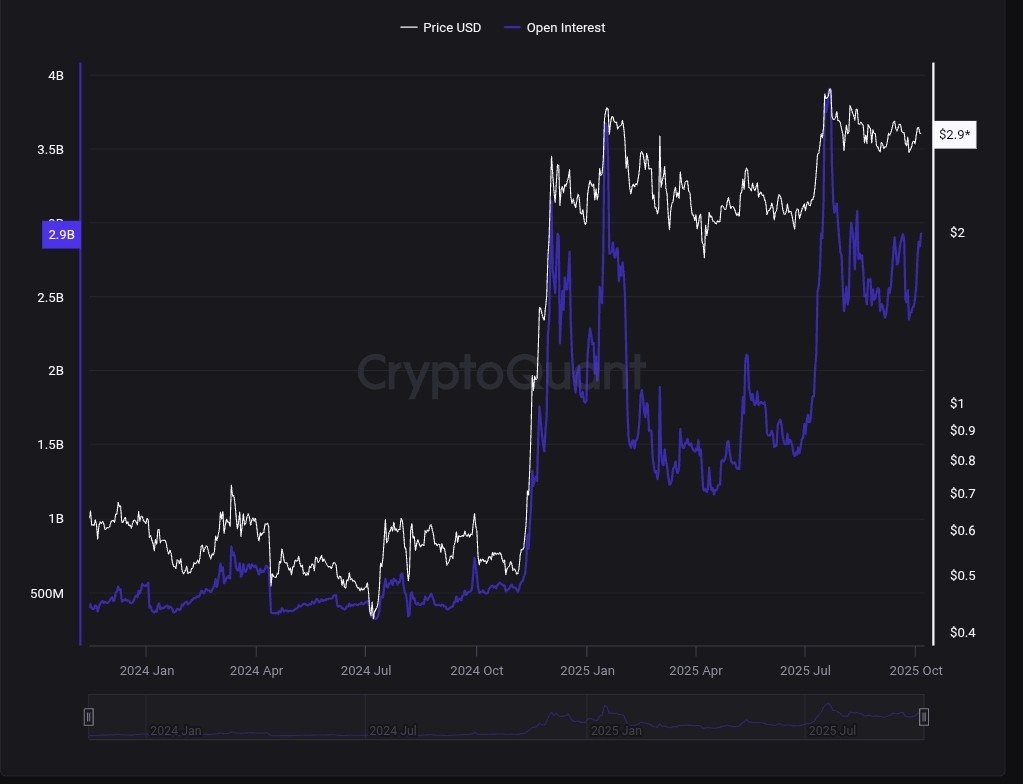

XRP’s open interest (OI) has continued to surge, highlighting growing investor interest in XRP even as the crypto asset struggles to secure a close above the key $3 resistance.

According to CryptoQuant data, XRP’s futures open interest has climbed steadily since the start of October, nearing $3 billion on Monday.

The recent rise marks a significant turnaround from late September, when open interest fell to $2.34 billion amid cooling sentiment and price weakness.

Since then, XRP’s price has rebounded roughly 9%, climbing from $2.74 to $2.99, while open interest expanded by nearly $600 million. This suggests that new leveraged positions are entering the XRP market.

Crypto analysts view this pattern as a sign that traders are gearing up for volatility and betting on a potential breakout.

Meanwhile, Coinglass data paints an even stronger picture of trader confidence, placing XRP’s total open interest across all exchanges at an impressive $8.94 billion.

The difference between CryptoQuant and Coinglass figures stems from their market coverage. While CryptoQuant tracks major exchanges, Coinglass includes a wider set of platforms such as the Chicago Mercantile Exchange (CME).

XRP Struggles at $3 Resistance Despite Leveraged Demand

XRP trades just below the $3 mark at the time of writing, a level that has repeatedly served as a major resistance point over recent weeks. The bulls have attempted multiple breakouts, but the bears have consistently defended the zone, preventing a clean continuation to higher levels

Interestingly, while open interest has increased, XRP’s trading volume has dropped by 11% in the past 24 hours to $5.76 billion, according to CoinMarketCap data. This divergence (rising open interest but falling volume) suggests that market momentum may be weakening, potentially setting the stage for a consolidation or short-term pullback.

Still, sentiment across the community remains optimistic especially with the many positive developments around XRP exchange-traded funds (ETFs). Last week, a senior Bloomberg ETF analyst noted that XRP ETF approval is now inevitable as the U.S. Securities and Exchange Commission (SEC) clears the path for multiple crypto funds.

Accordingly, crypto analyst CasiTrades predicted that if bulls successfully flip $3 into support, XRP could rally toward $3.24 before targeting the Wave 3 level at $4.5. Similarly, market strategist Mikybull highlighted that XRP could soon enter its final bullish wave, projecting a potential breakout to a conservative range between $6 and $10, and possibly an ambitious target of $21 if broader market conditions remain favourable.