Ark Invest, a leading investment firm led by Cathie Wood, has released a striking new bitcoin price prediction for 2030.

According to its latest report, BTC could hit $2.4 million by 2030, which is a significant jump from its previous bull-case forecast of $1.5 million.

The updated estimate is based on a newly developed valuation model that discounts lost or long-dormant BTC holdings, offering a clearer picture of the coin’s true liquid supply.

Ark Invest treated all bitcoin in circulation in earlier models as equally available. However, that is no longer realistic, as millions of bitcoins are believed to be lost forever, either locked in forgotten wallets or inaccessible keys.

The firm’s new approach filters out the lost BTC assets and focuses on the supply likely to be traded or used in the market.

The more “aggressive” model better reflects bitcoin’s actual scarcity, said David Puell, the Ark Invest analyst behind the report. He added that most valuation models today don’t factor in just how much of bitcoin’s supply is gone for good.

Read also: What is bitcoin (BTC) and why is it important?

Ark’s Bitcoin Price Prediction 2030

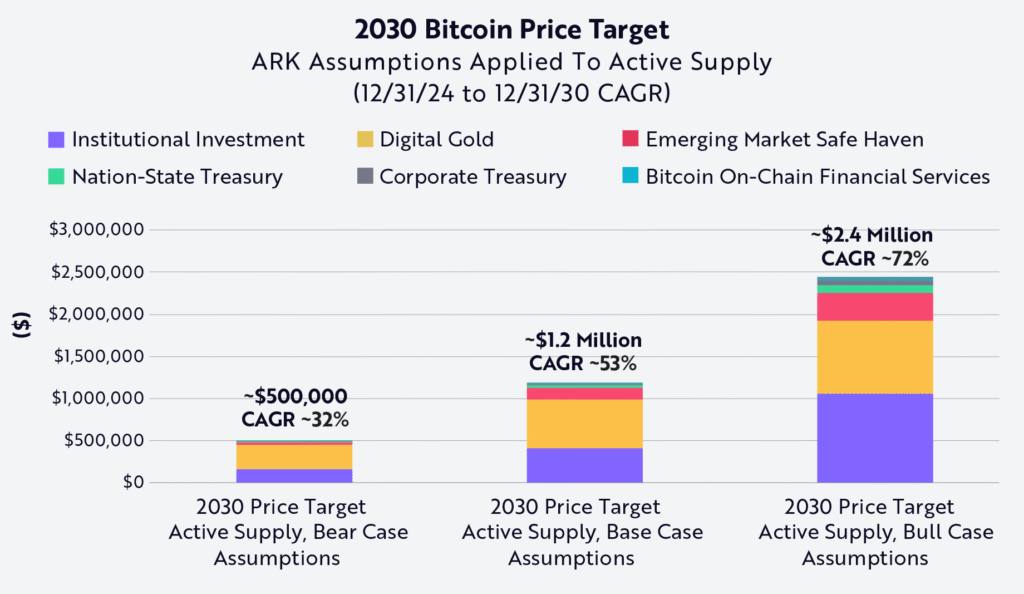

Using this refined methodology and considering the cryptocurrency market cycles, the investment firm outlined three bitcoin price prediction for 2030:

- Bull Case – The firm predicts BTC to reach $2.4M by 2030 in a crypto bull market scenario. This translates to a 72% annual return from the end of 2024, driven largely by institutional adoption.

- Base Case – For a base case scenario, Ark Invest projects BTC price to trade at $1.2M per asset by 2030. This marks a 53% compound annual growth rate (CAGR), assuming moderate adoption and BTC solidifying its role as digital gold.

- Bear Case – A more conservative 32% CAGR was projected by the firm, which still significantly above current levels. Particularly, for a crypto bear market scenario, Ark Invest predicts BTC to trade at $500,000 by 2030. Interestingly, even in the projected bear case, bitcoin’s value more than doubles from its 2024 price of $93,500 at the time of writing, indicating the firm’s strong long-term conviction in the largest crypto asset by market cap.

According to the report, these BTC price predictions for 2030 relies on assumptions made regarding the total addressable markets (TAMs) and penetration rates discussed in the report. “Bitcoin may fail to reach these price targets if any of the TAMs or penetration rates are not met,” Puell stated.

Read also: Is it too late to invest in bitcoin?

Institutional Demand and Emerging Markets

According to Ark Invest, one of the most significant driver behind the bull-case forecast is institutional investment. As more hedge funds, public companies, and pension funds diversify into BTC, the demand curve could steepen sharply, especially with supply capped at 21 million.

Bitcoin’s increasing use in emerging markets also plays a crucial role in all scenarios. In economies plagued by inflation, weak local currencies and tariff wars, BTC is becoming a viable alternative to preserve wealth.

With just a smartphone and internet access, individuals can sidestep traditional banking and hold an appreciating asset. Notably, countries like Russia are turning to crypto for their oil trades amid Western sanctions.

“[Bitcoin’s] low barriers to entry provide individuals with internet connections in emerging markets access to an investment alternative that may provide capital appreciation over time, as opposed to defensive allocations like the U.S. dollar, to preserve purchasing power and avoid the devaluations of their own national currencies,” Puell said.

“[We] also believe that this more experimental exercise highlights that bitcoin’s scarcity and lost supply are not reflected in most valuation models today,” the analyst added.

Read also: Standard Chartered Forecasts $500K Bitcoin (BTC) as Trump Advances U.S. Strategic Crypto Reserve

Bitcoin scarcity is still underestimated

The report also makes a key philosophical point: most investors still underestimate bitcoin’s scarcity. Notably, lost BTC assets, long-term holders, and institutional cold storage wallets reduce active supply more than most models assume.

This scarcity, combined with rising global demand, is the core of Ark’s optimistic outlook. Per a Bitwise report, public companies increased their bitcoin holdings by 16.1% in Q1 2025, taking cumulative holdings above 688,000 BTC.

While Ark Invest’s $2.4 million bitcoin price prediction 2030 may sound extreme, it is based on extensive data. Nonetheless, whether or not BTC hits that mark by 2030, the firm’s projection shows just how far mainstream institutions have come in viewing crypto as a long-term asset class.

Notably, a report by Coinbase and EY-Parthenon showed that 83% of institutional investors plan to increase their crypto exposure in 2025. Likewise, VanEck has projected the timeline for BTC and ether (ETH) to reach bull market peaks.