Bitcoin’s recent price weakness has rattled retail traders, triggered heavy liquidations, and pushed the crypto fear and greed index into the extreme fear territory. However, beneath the surface, a different story is unfolding.

On-chain data suggests large crypto holders, commonly referred to as whales, are quietly increasing their Bitcoin exposure even as smaller investors reduce risk. This divergence between smart money behaviour and retail positioning has historically preceded major market shifts.

While price action remains fragile in the short term, growing whale accumulation is beginning to shape a narrative that long-term participants may be preparing for the next cycle.

Retail Coins Move to Exchanges

Multiple blockchain analytics platforms show a steady rise in Bitcoin balances held by large wallets controlling thousands of BTC. These entities typically include long-term investors, institutional custodians, and high-net-worth participants.

Rather than distributing coins during the latest downturn, many whale wallets have added to their positions. This pattern mirrors accumulation phases observed during previous market corrections in 2019, 2020, and mid-2022.

At the same time, Bitcoin exchange reserves are rising. According to on-chain analyst Axel Adler Jr., exchange balances increased from 2.718 million BTC to 2.752 million BTC since January 19, adding roughly 34,000 BTC to trading platforms.

Adler also noted that a move above 2.76 million BTC could heighten short-term selling pressure, stressing that “we haven’t reached full capitulation yet” despite BTC trading at two-month lows and the broader market in a deep bearish phase.

Per CryptoQuant data, Bitcoin inflows to exchanges surged in January 2025, reaching approximately 756,000 BTC, with Binance and Coinbase accounting for a large share. Since early February, another 137,000 BTC has flowed into exchanges, showcasing heightened repositioning activity.

This pattern suggests that retail and short-term traders are moving coins closer to potential sell-side liquidity, while whales are accumulating off-exchange. Historically, whales tend to buy when liquidity is thin and sentiment is negative, using market weakness to build positions at discounted prices.

On the other hand, retail traders often reduce exposure during the same periods due to fear and margin pressure. This growing imbalance between accumulation and distribution suggests that large players view current price levels as attractive for long-term investing in cryptocurrencies.

Read also: Strategy Buys 22,305 Bitcoin for $2.13B as Holdings Top 709,000 BTC

Futures Market Sees Historic Deleveraging

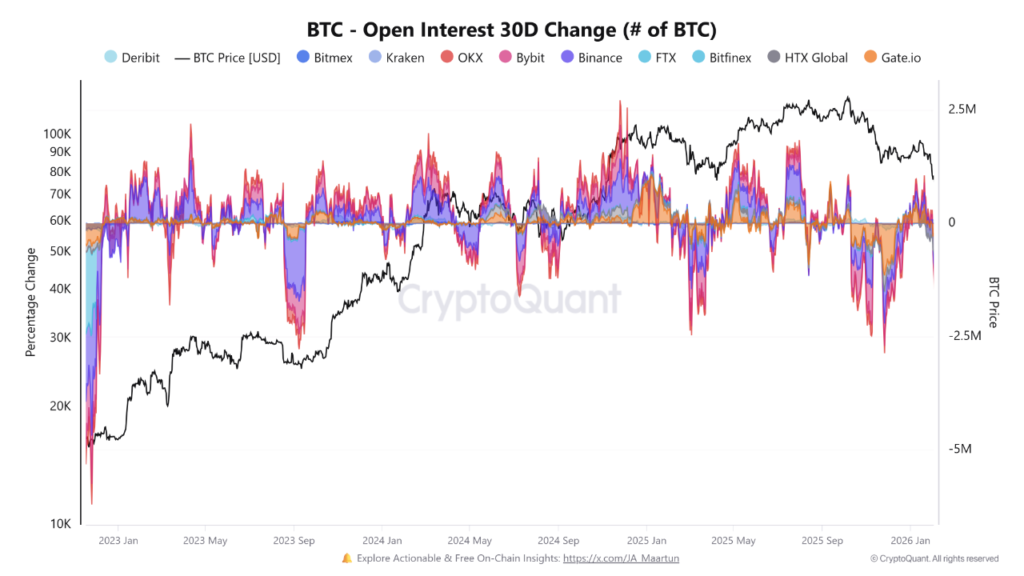

Derivatives data confirms that Bitcoin’s recent decline is driven heavily by deleveraging rather than purely spot selling.

According to CryptoQuant data, roughly 744,000 BTC worth of open interest has been wiped from major exchanges over the past 30 days. This is equivalent to about $53 billion as BTC trades near $71,000 at press time. The reduction spans multiple platforms, including Binance (276,869 BTC decline in open interest), Bybit (330,828 BTC decline) and OKX (136,732 BTC decline), amongst other exchanges.

In parallel, Bitcoin’s futures cumulative volume delta (CVD) has fallen by $40 billion over the past six months, signaling persistent dominance of market sell orders. On Binance alone, derivatives CVD sits near -$38 billion, highlighting sustained aggressive selling. Likewise, Bybit’s CVD flattened near $100 million after a large December liquidation wave, while HTX stabilized around -$200 million.

Historically, large-scale deleveraging often coincides with late-stage corrections, where weak hands exit, and longer-term participants begin positioning.

Read also: Standard Chartered Sees Ethereum Outperforming Bitcoin in 2026, Projects ETH to Hit $7,500

What’s Next for Bitcoin Price?

While BTC seems to be consolidating around $71,000, analyst Mark Cullen projects a possible decline to $50,000 in the long term. However, he expects a short-term rebound to the $86,000 to $89,000 range following Bitcoin’s recent sweep below $71,000 in early Thursday.

Likewise, crypto analyst Scient has submitted that Bitcoin rarely forms durable bottoms in a single day or week. According to him, bottoms often develop through two to three months of consolidation near major support zones in higher timeframes. Scient’s analysis further shows that BTC could retrace to the $60,000 to $50,000 range before resuming any major uptrend.

At the time of writing, BTC is trading at $71,118, down 7% and 19.3% in the past 24 hours and seven days, respectively.