On April 2, 2025, the crypto community was shaken when FDUSD, a stablecoin issued by Hong Kong-based First Digital Trust (FDT), lost its $1 peg.

The turmoil began when Justin Sun, founder of the TRON blockchain, claimed that FDT was insolvent and unable to fulfill client fund redemptions. He urged users to take immediate action to secure their assets.

“First Digital Trust (FDT) is effectively insolvent and unable to fulfill client fund redemptions. I strongly recommend that users take immediate action to secure their assets,” Sun wrote on X.

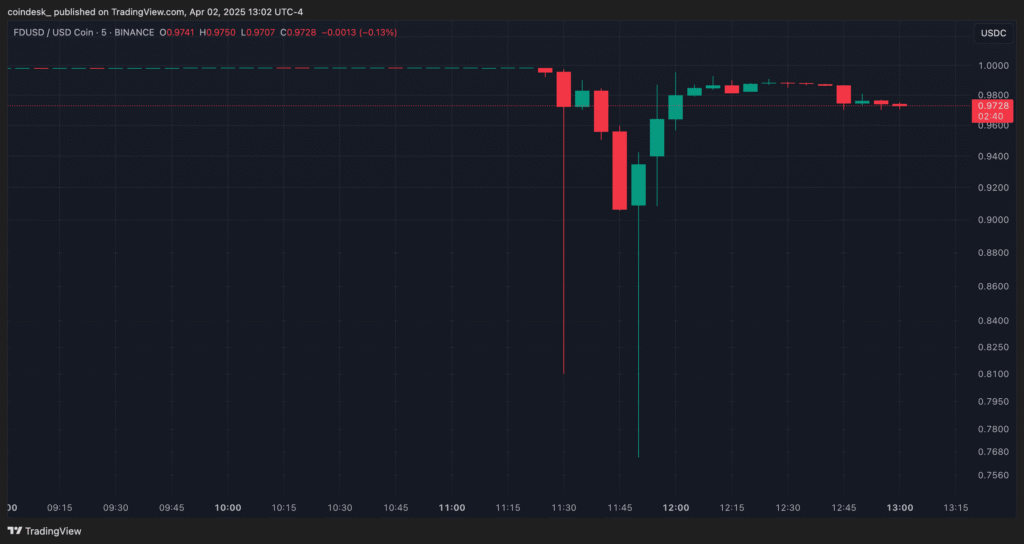

Sun’s claims had an immediate impact on FDUSD’s value. The stablecoin, typically pegged at $1, dropped to $0.87 against Tether’s USDT and $0.76 against Circle’s USD Coin (USDC) on Binance, the primary crypto exchange listing FDUSD. Recall that Binance delisted 9 stablecoins in Europe in March, to comply with MiCA’s regulations.

First Digital Trust refutes allegations and promises legal action against Tron founder

In response, FDT firmly denied Sun’s allegations. The company stated that it is “completely solvent” and assured stakeholders that every dollar backing FDUSD is secure and accounted for, primarily held in U.S. Treasury Bills.

“The recent allegations by Justin Sun against First Digital Trust are completely false. This dispute is with TUSD and not with $FDUSD. First Digital is completely solvent. Every dollar backing $FDUSD is completely secure, safe, and accounted for with U.S.-backed T-Bills. The exact ISIN numbers of all of the reserves of FDUSD are set out in our attestation report and clearly accounted for,” First Digital reacted.

The firm characterized Sun’s statements as a “smear campaign” aimed at undermining a competitor and announced its intention to pursue legal action against the Tron founder to protect its rights and reputation.

The backdrop of FDUSD depegging incident: Previous issues with TUSD reserves

The latest dispute over FDUSD reserve is linked to earlier issues with Techteryx’s TrueUSD (TUSD) stablecoin. Notably, court filings revealed that $456 million of TUSD’s reserve assets were tied up in illiquid investments, leading to liquidity challenges.

During that period, Sun provided financial support to stabilize TUSD. According to filings from U.S. law firm Cahill Gordon & Reindel, these reserve assets were initially intended for the Aria Commodity Finance Fund (Aria CFF).

However, they were allegedly redirected without authorization to a separate Dubai-based entity, Aria Commodities DMCC. Per the report, First Digital Trust served as the fiduciary manager of TUSD’s reserves and allegedly facilitated the transfer.

FDT’s CEO, Vincent Chok, stated that his firm acted on Techteryx’s instructions. Chok also raised concerns about Know Your Customer (KYC) compliance issues linked to the stablecoin issuer.

Read also: Stablecoins: Their roles in the crypto ecosystem, types and associated risks

FDUSD repegs, redemption requests resume

Despite the brief FDUSD depegging incident, FDUSD began regaining stability on Wednesday and is trading at $0.99 at the time of writing.

According to a Thursday update, FDUSD successfully completed its first batch of redemption requests, with the corresponding burn transactions verifiable on-chain. This on-chain transparency has helped restore confidence in FDUSD, although concerns may still persist.

As the situation develops, the FDUSD depegging incident highlights the need for greater transparency in stablecoin reserves management. For users and investors, this episode serves as a reminder to always conduct thorough due diligence on the entities behind the digital assets they engage with.