Shiba Inu is back in the spotlight as its burn rate surges exponentially within 24 hours, reviving optimism in the memecoin’s deflationary roadmap while fueling bullish speculations for SHIB.

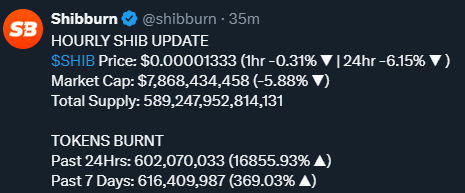

Per Shibburn data, Shiba Inu recorded a dramatic 16,855% surge in daily burn rate on Tuesday, which saw more than 602 million tokens permanently removed from circulation within a single day.

The burn frenzy was ignited by a Coinbase user who withdrew 600.7 million SHIB tokens from the exchange and sent them directly to the official Shiba Inu burn wallet.

Expert says scarcity still sells: Will burn-driven scarcity trigger a SHIB rally?

Reacting to the development, WallStreetBets founder Jamie Rogozinski celebrated the massive burn, teasing that it would thrill “anyone who enjoys setting things on fire.” He also noted that the burn helped trigger a 3% jump in SHIB’s price, pushing the asset to a seven-week high.

“SHIB just burned enough tokens to make even a pyromaniac proud, rallying 3% to a seven-week high,” Rogozinski said.

However, SHIB’s price later dropped over 6.15% amid a market-wide correction. Despite this, Rogozinski remains confident in the token’s deflationary appeal, stating that “scarcity still sells.”

The SHIB community has remained committed to reducing the token’s supply. Over 410.8 trillion SHIB tokens have been burned from its initial circulation to date, thanks to Ethereum co-founder Vitalik Buterin, who burned over 410 trillion SHIB in 2021. This historic move helped push SHIB to its all-time high of $0.00008845.

As of July 29, 2025, SHIB’s total supply stands at 589.25 trillion, with over 616 million SHIB tokens burned over the past week, marking a 369.03% increase compared to the previous week.

Market correction overshadows SHIB burn momentum

Despite the ongoing burn efforts, SHIB still trades at $0.00001319, down 3.6% in the last 24 hours. The price decline mirrors a wider downturn across the market, with Ethereum (ETH) falling 3.14% and XRP down 4.65% within the same period.

As Shiba Inu continues to focus on its deflationary roadmap and burn events, holders are questioning whether its burn-driven hype can convert into long-term value especially in the face of macroeconomic pressure and shifting investor appetite from memecoins.