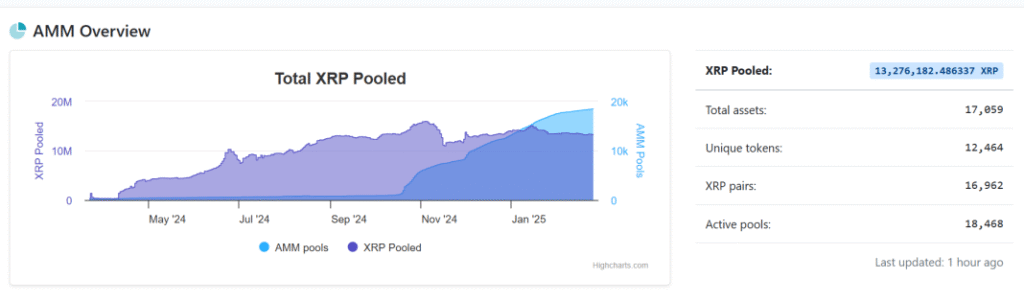

The XRP Ledger (XRPL) automated market maker (AMM) pools have seen a surge in liquidity, surpassing 13 million XRP. This milestone underscores the growing role of AMMs within the XRP ecosystem as more users engage in decentralized trading and liquidity provision.

XRP Scan data indicates that these pools now hold approximately 13.27 million XRP, valued at around $30 million at current market prices. The steady increase in liquidity enhances the XRP Ledger decentralized exchange (DEX), facilitating smoother transactions and more efficient market operations.

The rising adoption of AMMs also signals increased interest in pooled transactions, contributing to the network’s total value locked (TVL).

XRP Ledger AMM liquidity expansion

The number of AMM pools on the XRPL has expanded significantly according to XP Market, reflecting a broader shift towards decentralized finance (DeFi) applications. At the time of writing, there are over 18,400 active pools, supporting more than 17,000 crypto assets.

This rapid expansion gained momentum following the launch of the RLUSD/XRP AMM pool in January 2025, which was introduced after receiving validator approval for the AMM Clawback amendment.

Since its introduction, the RLUSD/XRP pool has quickly gained traction, securing its position as the fourth-largest AMM pool on the network, with over 671,000 XRP (approximately $1.52 million) in liquidity.

Meanwhile, the largest AMM pool, CRYPTO/XRP, holds around 3.8 million XRP ($8.7 million) at press time, reinforcing the growing adoption of the XRPL’s AMM ecosystem.

Read also: SEC Acknowledges Grayscale’s Spot XRP and Dogecoin ETF Filings, Approval Odds at 65%-70%

AMM pools as a strategic investment option

The rise in TVL across XRPL’s AMM pools has fueled optimism among traders and investors. Many within the XRP community believe that the expanding liquidity and growing participation in AMM pools signal a strong foundation for future market growth.

Some analysts also suggest that AMM pools can serve as a hedge during market volatility. According to Panos Mekras, co-founder of XRPL-focused firm Anodas, providing liquidity in stablecoin/token pairs may help offset losses during market downturns, despite some limitations during uptrends.

As liquidity continues to grow within XRP Ledger’s AMM pools, the network’s role in the DeFi scene is becoming more prominent. The increasing adoption of AMMs could further enhance the efficiency of XRP’s decentralized trading ecosystem, positioning the network as a key player in the evolving crypto space.

Read also: Why You Should Hold 1,000 to 10,000 XRP

XRP suffers 20% price decline

Amid the increasing liquidity in XRPL AMM pools, XRP price has suffered a 20% price decline in the past week, according to Coingecko data. Trading at $2.18 at the time of writing, the sharp retracement follows a broader crypto market decline fueled by bitcoin‘s descent to the $82,000 level on Wednesday.

In anticipation of a potential XRP exchange-traded funds (ETFs) approval, some XRP proponents believe the cryptoasset’s latest decline is a “buy-the-dip” opportunity.