XRP’s price has dropped to around $2.82, and the decline was preceded by significant whale activity.

Commonly known as whales, large holders have been moving millions of dollars worth of XRP to crypto exchanges, sparking concerns among analysts of a deeper correction ahead.

While technical patterns also indicate further downside, rising XRP open interest suggests the crypto asset is primed for a breakout above $3. This has created a critical moment for XRP price action as whale activity intensifies.

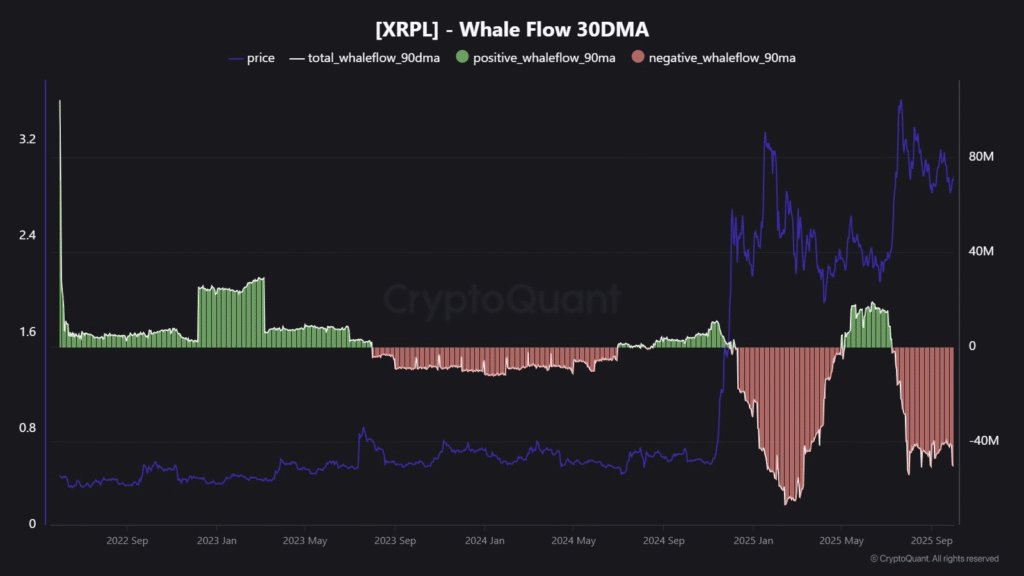

Whales Dump $50M Daily

According to on-chain data, XRP whales have increased their sell-side activity as the XRP price dropped below $3.

CryptoQuant analyst Maartunn revealed that over $50 million worth of XRP is flowing out of whale wallets daily on a 30-day moving average.

This surge in whale activity has coincided with a growing XRP supply on centralized exchanges, according to Glassnode data.

Trader CryptoOnchain noted in an X post that this strongly suggests whales are preparing for a major sell-off, stating:

“The data points to immense selling pressure, creating a high risk of a sharp correction. Conditions are ripe for a major price decline.”

Broader market sentiment is also turning bearish as fear levels rise to peaks last seen during the April 2025 sell-off following President Donald Trump’s tariff announcements. This fear, combined with whale movements, could keep XRP price under pressure in the coming weeks.

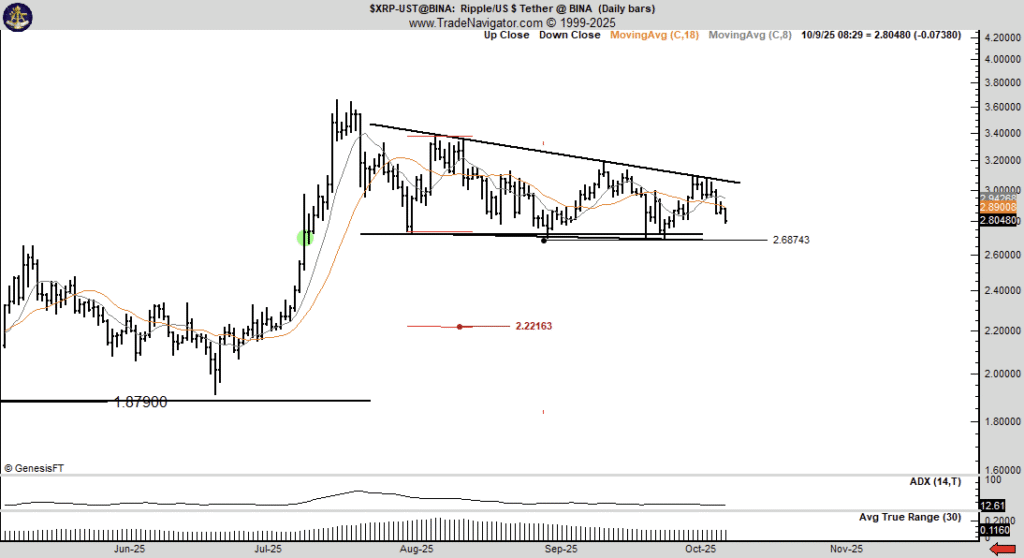

Technical Outlook: Descending Triangle Could Push XRP Price Toward $2.20

Well-known trader Peter Brandt has named XRP as a potential short candidate if it confirms a descending triangle pattern. According to the chart he shared, the descending triangle has formed with support around $2.75 and a horizontal resistance level above $3.

If XRP breaks below the triangle’s support, the measured target points to $2.20, representing a 22% drop from its current level.

“XRP is on my list of short candidates, but it is conditional upon completing the descending triangle,” Brandt said.

The area between $2.75 and $2.80 remains a crucial support zone. A break below could open the door to a steeper decline, while holding above this level could give bulls a chance to regain control.

XRP ETF Speculation Could Influence Market Sentiment

Despite the bearish technicals, some analysts believe XRP ETF speculation could provide short-term relief. Market commentator XRP Update recently suggested that the U.S. Securities and Exchange Commission (SEC) might approve an XRP ETF by October 18, 2025.

Recall that senior Bloomberg ETF analyst Eric Balchunas said XRP ETF approval is now “inevitable” as the SEC clears the path for multiple crypto funds.

Such an approval could be a turning point for institutional adoption and could bring new demand for XRP. However, traders are also cautious of a “sell-the-news” scenario, where whales might use the ETF approval as an opportunity to exit positions at higher prices.

“This could be a turning point for institutional adoption and market legitimacy,” XRP Update said.

Outlook for XRP Price

XRP price is currently caught between two opposing forces, including bullish hopes for XRP ETFs and bearish whale activity that’s increasing selling pressure.

In the short term, holding the $2.75–$2.80 support zone will be critical. If whales continue offloading and the descending triangle plays out, XRP could see further downside.

However, a positive ETF decision or strong buying support might help stabilize or reverse the decline. XRP is trading at $2.82 at the time of writing, and is down over 3% in the past 24 hours.