XRP price action is once again sitting at a critical level, with the altcoin consolidating around $2.75. The token is forming the base of a descending triangle, a technical setup that often signals weakness.

If selling pressure persists, XRP could fall into the $2.65 to $2.45 range, a move that would represent another 8–10% decline.

This bearish outlook aligns with a daily fair value gap (FVG) sitting between the 0.50 and 0.618 Fibonacci retracement levels. The liquidity-heavy zone could attract price action before serving as a launchpad for a potential recovery.

On-Chain Data Supports Key XRP Support Levels

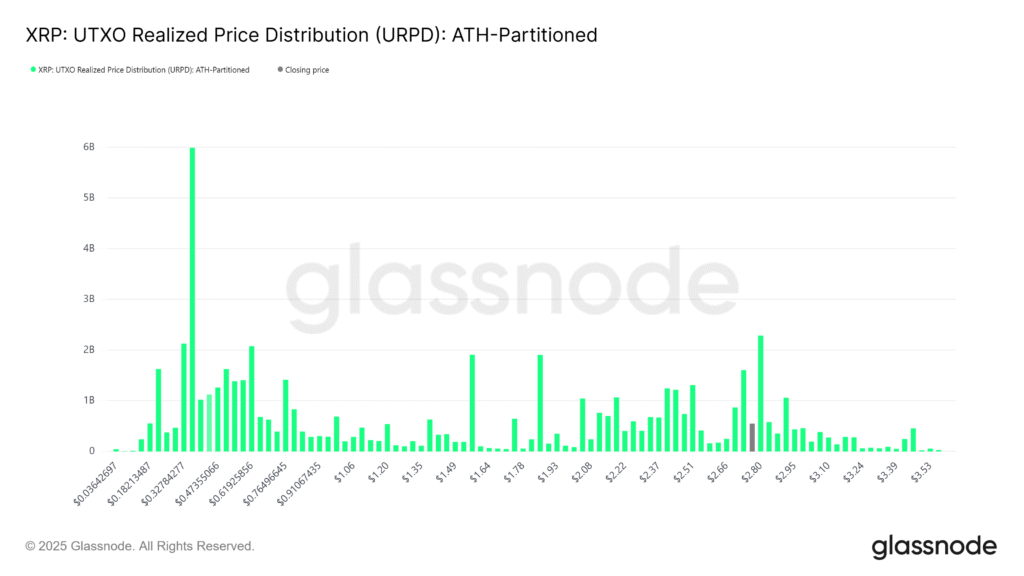

Glassnode’s Unrealized Price Distribution (URPD) for XRP highlighted a dense cluster of buyers between $2.45 and $2.55.

This zone represents the cost basis for many holders, which means it could act as strong support if XRP revisits it.

Aggressive buying in that area may provide the fuel for a rebound, reinforcing the idea that a dip could precede a sustainable rally.

Interestingly, XRP’s current price behaviour mirrors its fractal pattern from Q1. In that setup, the coin swept liquidity below support before rebounding strongly.

XRP has already tested $2.65 twice, and a final sweep into the $2.50 pocket remains possible before upside momentum builds again. The pattern’s weakness heading into the weekend, followed by potential volatility at the start of the week, adds weight to this outlook.

Accordingly, top analysts warn that XRP could retest the $2.50 area as early as Monday. Still, a decisive break above $2.90 could invalidate the bearish setup, opening the door for renewed bullish momentum. Until then, the market trajectory remains toward a final dip.

XRP’s Liquidity Compression and ETF Developments

Beyond technicals, XRP’s liquidity compression may be setting the stage for a larger move. According to Sistine Research, XRP is in its third compression phase since November 2024, built on three consecutively higher price points.

Such conditions often precede sharp breakouts when the order book imbalance is released.Sistine Research wrote on X: “As the price action compresses, so does the orderbook, with most liquidity compressing into a tighter and tighter range. This results in very large gaps in liquidity. XRP is on its 3rd compression since the election, with this being the tightest one yet at 3 consecutively higher price points.”

However, spot market flows still show sellers in control. CryptoQuant Analyst Pelin Ay also noted that the 90-day spot taker CVD favours sellers despite occasional buyer strength.

For XRP to sustain upside, buyers need to flip momentum with strong volume, and this is something yet to appear in recent data.

XRP ETF developments add another layer of volatility. Franklin Templeton’s XRP ETF decision has been pushed to November 14, while REX/Osprey’s XRPR ETF made a splash with nearly $38 million in first-day volume.

While these catalysts are significant, analysts caution that optimism may already be priced in, raising the possibility of a “sell the news” reaction.

XRP Price Prediction

In the mid-term perspective, the XRP price prediction suggests the token may retest $2.50 before staging a meaningful rebound. Large XRP accumulations at that level, combined with ETF-driven hype and compressed liquidity, could set the stage for a breakout. Positive developments such as the launch of the first-ever XRP-backed stablecoin by Flare Network could could to the possible rally.

However, if buyers fail to overpower sellers at the $2.50–$2.55 support range, the bearish setup could persist, leaving XRP vulnerable to deeper corrections.