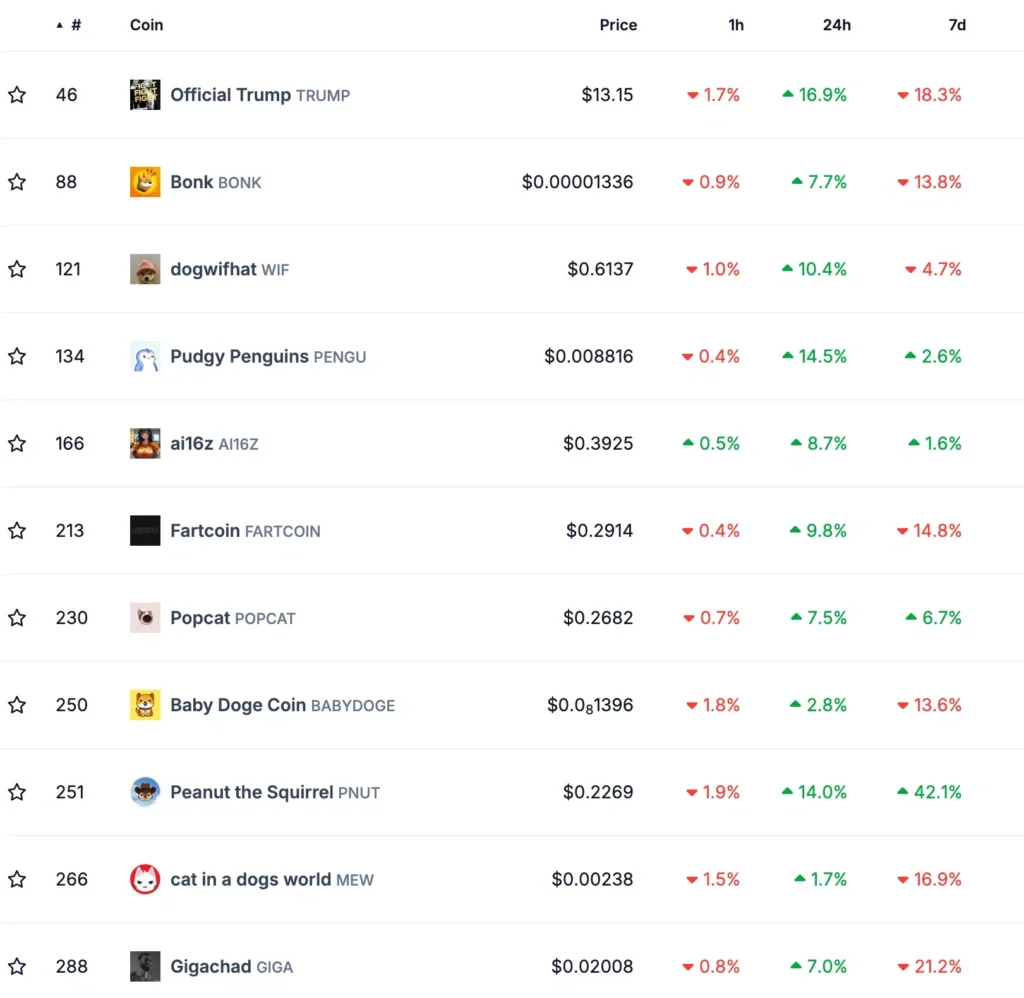

Solana memecoins kicked off the month of March 2025 with impressive gains, surging by double digits as crypto investors capitalized on recent market dips. According to Coingecko data, the total market capitalization of Solana meme coins rose by 4.5% to over $9.04 billion on Saturday.

Leading the rally, Official Trump soared by 18.1%, while Dogwifhat (WIF), Pudgy Penguins, ai16z, Fartcoin, and Peanut the Squirrel jumped by over 15% on March 1. Despite these gains, these tokens remain significantly below their all-time highs. At its peak, the total Solana memecoin market cap reached $25 billion, far higher than its current levels.

The rebound coincided with a broader recovery in both crypto and stock markets. Bitcoin (BTC) surged past $85,000, while Ether (ETH) climbed above $2,215. Solana (SOL) itself experienced a nearly 10% jump, reinforcing confidence in the ecosystem.

Market optimism and Federal Reserve speculation

The recent surge in memecoins and other risky assets follows an improvement in overall market sentiment. After this week’s sharp sell-off, the Dow Jones index rebounded by over 600 points, while major indices such as the S&P 500, Nasdaq 100, and Russell 2000 gained over 1%.

A key catalyst for the rebound is growing optimism that the Federal Reserve might cut interest rates earlier than expected.

This speculation intensified after weak U.S. economic data and concerns about upcoming tariffs on American imports.

If rate cuts materialize, they could inject liquidity into markets, benefiting high-risk assets like memecoins. However, the sustainability of this rally remains in question.

Read also: Solana ETFs launch in 2025— VanEck and Bitwise execs weigh in

3 key risks facing Solana memecoins

Despite the recent surge, Solana memecoins face three major risks that could threaten their momentum:

1. Potential dead cat bounce

While prices have jumped, there is a possibility that this rally is merely a dead cat bounce (DCB)—a temporary recovery before the downtrend resumes. In volatile markets, short-term gains often attract speculative traders, only for prices to crash again.

2. Whale sell-offs and profit-taking

Many large investors (whales) who made significant profits from Solana memecoins have already exited their positions. For instance, data shows that the top 15 most profitable Dogwifhat (WIF) investors have sold 100% of their holdings. A similar pattern has emerged across other meme coins, raising concerns about potential rug pulls which is a common risk in speculative crypto markets.

3. Market fear and geopolitical uncertainty

The crypto fear and greed index has dropped to 25, signaling fear among investors. Similarly, the broader fear and greed index tracked by CNN Money has plunged to 18, indicating extreme fear. In such conditions, riskier assets like memecoins tend to underperform. Additionally, political developments add another layer of uncertainty.

President Donald Trump has vowed to impose tariffs on key allies like Canada and Mexico, a move that could drive inflation higher and slow U.S. economic growth. If inflation rises, it could reduce the likelihood of Fed rate cuts, negatively impacting speculative assets.

In conclusion, Solana memecoins have enjoyed an impressive rally so far in March, fueled by dip-buying and improved market sentiment. However, the risks of a dead cat bounce, whale exits, and broader market fear remain significant. While some investors see opportunity, caution is warranted as crypto markets remain highly volatile.