Nigeria’s Securities and Exchange Commission (SEC) has introduced revised minimum capital requirements for regulated capital market operators, a move that significantly raises the financial thresholds for firms operating across the country’s investment landscape.

The updated framework applies to a wide range of entities, including stockbrokers, issuing houses, fund managers, market infrastructure providers, financial technology (fintech) firms, and Virtual Asset Service Providers (VASPs).

Revised Minimum Capital Requirements for Capital Market Operators in Nigeria

The revised minimum capital requirements were published through an official SEC circular and represent one of the most comprehensive regulatory updates in Nigeria’s capital market in recent years.

According to the Nigerian SEC, the changes are intended to strengthen investor protection, improve market stability, and ensure that capital market operators have sufficient financial capacity to meet their obligations in an increasingly complex regulatory environment.

Minimum capital refers to the amount of shareholders’ funds a regulated firm must maintain to retain its operating licence. By raising these thresholds, the SEC is increasing the financial bar for participation in Nigeria’s capital market, placing greater emphasis on balance sheet strength, operational resilience, and long-term sustainability.

Why the Nigerian SEC Revised Minimum Capital Requirements

The SEC explained that the revision was driven by structural changes in Nigeria’s financial system, including the rapid expansion of digital finance, the growing influence of technology-driven investment platforms, and the introduction of new asset classes such as virtual assets.

The regulator also highlighted the need to align capital requirements with the scale, scope, and risk exposure of different business models operating within the capital market.

In practical terms, the Commission believes that firms managing investor funds, structuring public offerings, or operating trading and settlement systems must maintain stronger financial buffers. These buffers are expected to help operators absorb losses, manage operational risks, and protect investors during periods of market stress.

New Capital Thresholds for Issuing Houses and Underwriters

One of the most notable changes under the revised minimum capital framework affects issuing houses. Issuing houses are financial institutions that help companies raise funds from the public by structuring and managing the sale of shares or bonds. They play a central role in public offerings and broader capital-raising activities.

Under the revised rules, issuing houses that do not underwrite securities are now required to maintain a minimum capital of ₦2 billion. Issuing houses that also perform underwriting functions must hold at least ₦7 billion.

Underwriters are firms that commit to purchasing securities from an issuer and reselling them to investors, effectively guaranteeing that the issuer raises the targeted funds. Because underwriters carry the risk of unsold securities, the Nigerian SEC has set their minimum capital requirement at ₦5 billion, reflecting the financial exposure associated with the role.

Revised Capital Rules for Brokers, Dealers, and Custodians

Stockbroking firms are also affected by the revised minimum capital requirements. Brokers, who execute buy and sell orders on behalf of investors, must now maintain a minimum capital of ₦600 million. Dealing firms, which trade securities using their own funds, are required to hold ₦1 billion. Firms that combine both functions, commonly known as broker-dealers, now face a ₦2 billion capital threshold.

The framework further strengthens requirements for custodians. Custodians are institutions responsible for holding and safeguarding investors’ securities, such as shares and bonds, while ensuring proper record-keeping and asset protection.

Given their role in securing client assets, the SEC has raised custodians’ capital requirements to reinforce confidence in how investor funds and securities are managed.

How the SEC Defines Virtual Asset Service Providers (VASPs)

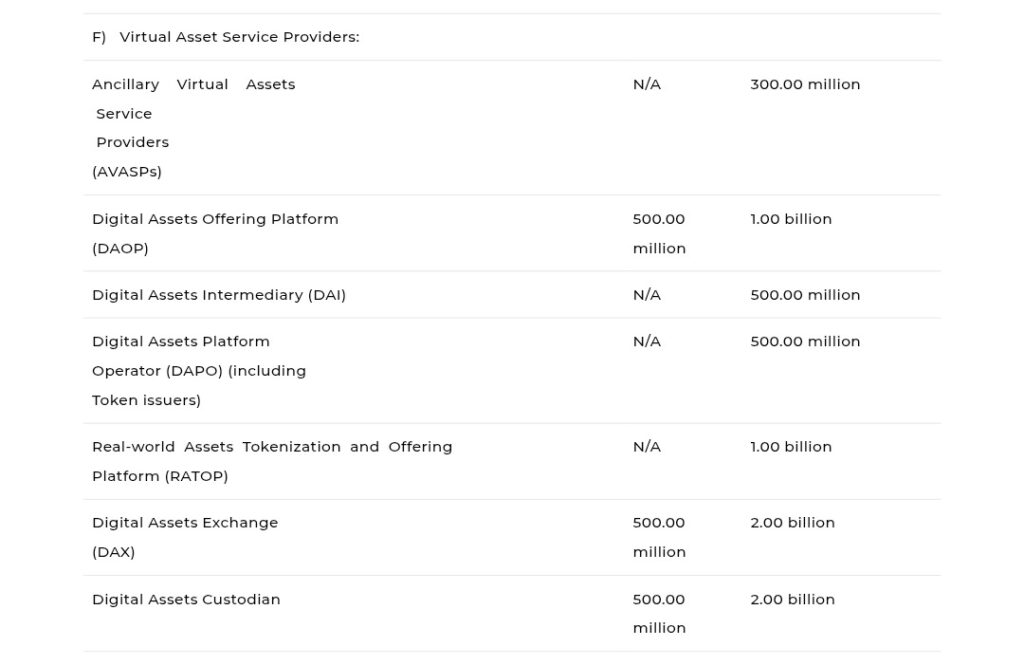

A key feature of the revised capital framework is the formal inclusion of digital asset firms under Nigeria’s capital market regulation. Virtual Asset Service Providers, commonly referred to as VASPs, are businesses that offer services related to cryptocurrencies and other digital assets. This category includes crypto exchanges, digital asset custodians, brokers, and platforms that facilitate the transfer, storage, or trading of virtual assets.

Under the new SEC rules, Digital Asset Exchanges (DAXs) and digital asset custodians must maintain a minimum capital of ₦2 billion. Virtual Asset Offering Platforms (DAOPs) are required to hold ₦1 billion, while virtual asset intermediaries face a ₦500 million requirement.

Ancillary service providers supporting virtual asset operations are also subject to a ₦300 capital threshold. Notably, real-world assets tokenization and offering platforms are now required to maintain a minimum capital of ₦1 billion.

By clearly defining and regulating VASPs, the Nigerian SEC is strengthening oversight of the digital asset sector. The move is expected to improve investor confidence while reducing systemic and operational risks within the growing virtual asset market.

Read also: Wall Street and Crypto Industry Leaders Clash Over How the SEC Should Regulate Tokenization

Market Infrastructure Operators and Compliance Timeline

Market infrastructure operators, including clearing and settlement companies and securities exchanges, have also seen their capital requirements revised upward. These entities ensure that trades are processed, settled, and recorded accurately, making them essential to the functioning of the capital market.

Clearing and settlement companies must now maintain a minimum capital of ₦5 billion, while major exchange operators are required to hold up to ₦10 billion.

Notably, all affected capital market operators have until June 30, 2027, to comply with the revised minimum capital requirements. The SEC has warned that firms that fail to meet the new thresholds within the transition period may face sanctions, including suspension or withdrawal of operating licences.

Read also: Ripple Secures Preliminary EMI Licence in Luxembourg: Why This Matters?

What the Revised Capital Framework Means for Nigeria’s Crypto Market: Industry Leaders’ Reactions

Industry analysts expect the new capital regime to encourage consolidation across the market, as smaller firms explore mergers or strategic partnerships to meet the higher financial thresholds. Larger and better-capitalized operators may benefit from improved investor confidence and a more stable operating environment.

Moreover, the Nigerian SEC’s revised requirements signal a clear push toward a more resilient, transparent, and investor-focused capital market. While the higher thresholds may create pressure for some operators, especially local VASPs, the regulator maintains that the long-term outcome will be a stronger market capable of supporting sustainable growth, innovation, and investor protection.

Reacting to the development, Senator Ihenyen, Lead Partner at Infusion Lawyers, and Executive Chair of the Steering Committee of the Virtual Asset Service Providers Association (VASPA) said in a statement to Nitadel: “Generally, I understand that SEC’s new capital requirements for market operators are meant to ensure resilience in the capital market, and this is welcomed from a consumer protection and investor protection point of view. To this extent, we could say the new requirements can enhance innovation by operators. But whether a significant increase in minimum capital requirements of market operators will not avoidably disrupt them is an impact that the SEC also needs to consider.”

Weighing in on the potential impact on VASPs, Ihenyen sees “the new capital requirements to be potentially stifling of innovation” in the nascent industry. “Here’s a space where operators are still trying to find their commercial feet in Nigeria’s nascent virtual assets industry; When you hike capital requirements in such a young industry, the most likely result you will get is stifling innovation, until it cannot afford to breathe anymore,” he explained.

Accordingly, he recommends that “the SEC should seriously consider an adaptive, gradual, and truly risk-based and tiered approach to regulation. This will particularly benefit local innovators who, essentially, hold the key to Nigeria’s global competitiveness in the future of finance.”

Lucky Uwakwe, Chairman of the Blockchain Industry Coordinating Committee of Nigeria (BICCoN), also criticised the SEC’s revised capital requirements, calling them an unrealistic barrier that ignores the economics of crypto businesses in Nigeria. He said regulators often confuse transaction volume with profit, arguing that licence fees of up to ₦2 billion (about $1.33 million) for VASPs, excluding compliance costs, are disproportionate to the value the market offers operators.

Uwakwe also warned that Nigeria lacks the leverage to enforce such rules beyond its borders, making offshore operations easy and pushing local players underground or to more profitable African markets. He added that similar objections were raised during the earlier ₦200 million licence proposal, suggesting industry feedback has been overlooked.

“As an industry leader and the current chairman of BICCoN, we made a call against the ₦200 million license regime in the past. If after a few years we now see ₦2 billion, it clearly means regulators have not been listening or taking community feedback seriously,” he said in a statement to Nitadel.

Urging regulators to rethink their approach and emulate fellow African countries like South Africa and Ghana, he stressed that Nigeria’s strength lies in its active users, not in restrictive policies that risk stifling innovation and growth.

Historically, the Nigerian government has provided limited support to the cryptocurrency sector and has often taken an antagonistic stance. In previous years, before the enactment of the Investments and Securities Act (ISA) 2025, the government had clamped down on several crypto companies, prompting exchanges like Binance, KuCoin, and OKX to exit the Nigerian market.